CPP2 payroll deductions 2026 are one of those “small line item, big headache” changes if your payroll isn’t configured properly. If you employ higher earners, pay bonuses, or you are growing from “owner-run” into a real team, CPP2 can show up fast and create year-end cleanups you did not budget time for.

The good news is that CPP2 is very manageable when you understand where it applies and you build a couple of quick checks into your monthly routine. The goal is simple: withhold the right amount, remit on time, and avoid T4 amendments that chew up February.

This article walks through what CPP2 is, the 2026 thresholds and rates, how CPP2 appears in source deductions, what to verify in your payroll software, and the most common mistakes we see when CPP2 is missed or capped incorrectly. You will also get an employer checklist you can hand to your bookkeeper, payroll admin, or outsourced provider.

CPP vs CPP2 in 2026 and why employers should care

CPP has been enhanced in phases over several years. The “base” CPP and the first enhancement layer apply up to the Year’s Maximum Pensionable Earnings (YMPE). CPP2 is a second layer that applies only to earnings above the YMPE and up to the Year’s Additional Maximum Pensionable Earnings (YAMPE). CRA explains the enhancement framework and how CPP2 fits into it in its guide to CPP enhancement and second additional contributions (CPP2).

Why does this matter to employers?

Because you match employee CPP contributions. So when CPP2 kicks in for an employee, it is not only a bigger deduction on their pay stub. It is also a direct employer payroll cost increase.

For many small and mid-sized businesses, CPP2 becomes noticeable in three situations:

A growing role crosses the YMPE mid-year due to raises or overtime.

A commission plan or bonus pushes an employee above the YMPE in a single pay period.

Owner-managers adjust salary levels and accidentally trigger CPP2 without planning for it.

CPP2 payroll deductions 2026 also add another moving part in payroll configuration. Most payroll systems can handle it, but only if they are updated and the earnings are coded correctly.

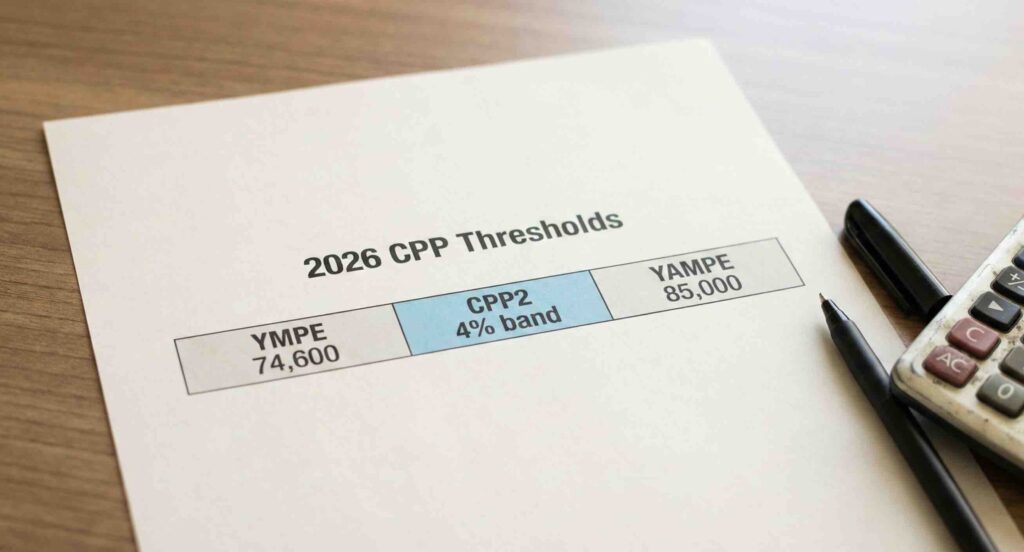

2026 thresholds and rates you should have in your payroll binder

Let’s keep the numbers practical. In 2026, the key thresholds and rates are:

YMPE: $74,600

YAMPE: $85,000

Base exemption: $3,500

CPP rate (employee and employer): 5.95%

CPP2 rate (employee and employer): 4%

CRA posts the official CPP contribution rates, maximums, and basic exemption details for employers in its payroll deductions guidance.

And CRA posts the official CPP2 contribution rates and maximum annual CPP2 amounts, which is what your payroll software should be using to cap deductions correctly.

What employers usually care about from a budgeting standpoint is the annual maximums. For 2026, CRA’s tables show the maximum annual CPP contribution per employee (and per employer match) and the maximum annual CPP2 contribution per employee (and per employer match). Once someone’s year-to-date contributions hit the max, payroll should stop withholding for the remainder of the year.

This is where CPP2 payroll deductions 2026 can go wrong in real life: the system either does not start CPP2 when it should, or it keeps withholding CPP2 after the maximum is reached.

How CPP2 payroll deductions 2026 show up in source deductions

In plain English, CPP works like this:

CPP (5.95%) applies on pensionable earnings up to the YMPE, after considering the basic exemption rules and the CRA per-pay calculation method.

CPP2 (4%) applies only to the slice of pensionable earnings between the YMPE and the YAMPE.

Many payroll stubs show CPP and CPP2 as separate lines. That is normal and usually a good sign because it means your software is treating CPP2 distinctly.

CPP2 payroll deductions 2026 calculation examples you can use for budgeting

These are simplified annual examples so you can sanity-check your payroll costs. Exact per-pay results will vary by pay frequency and CRA tables, but the budgeting takeaway will hold.

Example 1: Employee earns $60,000 in 2026

This employee does not reach the YMPE. CPP2 does not apply.

You will see CPP deductions, but not CPP2 payroll deductions 2026.

Example 2: Employee earns $80,000 in 2026

CPP applies up to the annual maximum.

CPP2 applies to the portion between $74,600 and $80,000.

That slice is $5,400. At 4%, CPP2 is about $216 for the employee and $216 for the employer for the year.

Example 3: Employee earns $90,000 in 2026

CPP maxes out as usual.

CPP2 applies only up to the YAMPE.

The CPP2 slice is $85,000 minus $74,600, which is $10,400. At 4%, CPP2 is $416 for the employee and $416 for the employer for the year.

So your clean budgeting rule is this: once compensation hits $85,000 or higher, CPP2 payroll deductions 2026 add up to $416 per year of employer cost per employee (plus the matching employee deduction).

If you have ten employees over the YAMPE, that is $4,160 of incremental employer CPP2 cost that should be in your payroll budget, not treated as a surprise in November.

Payroll setup checks for 2026 (software, process, and accounts)

If I could pick one theme for CPP2 payroll deductions 2026, it would be this: most issues are not “math issues.” They are setup and process issues.

Here are the checks that typically take 20 to 30 minutes and prevent the messy stuff later.

First, confirm your payroll software is updated for 2026 and that CPP2 is enabled. If you outsource payroll, ask your provider what they changed at year start and whether they tested CPP2 on sample pay runs.

Second, review which earning types are pensionable. Regular wages are obvious. Certain taxable benefits can be pensionable too, and that can push an employee into CPP2 territory without anyone noticing. When payroll coding is inconsistent, CPP2 payroll deductions 2026 can be under-withheld even if the employee’s total compensation is correct.

Third, confirm that your general ledger mapping makes it easy to reconcile. You want clear postings for:

Employer CPP expense (and employer CPP2 expense if your system separates it).

CPP payable (and CPP2 payable, or one combined CPP payable depending on your chart of accounts).

Remittance clearing accounts if you use them.

If your payroll journal lumps everything into one account, the remittance reconciliation becomes more manual. And manual is where errors like “we missed CPP2 on that bonus run” tend to hide.

Fourth, check your remittance schedule and due dates. Your remitter type is based on average monthly withholding amount (AMWA) and determines how often and when you must remit. CRA outlines types of payroll remitters and how AMWA affects your remittance frequency, which is worth confirming any time payroll grows. If you ever need to sanity-check the mechanics behind what’s withheld and what gets remitted, see our guide to calculating and remitting employee deductions in Canada and compare it to your payroll register.

CPP2 payroll deductions 2026 do not change your remitter type by themselves, but higher payroll totals can move you into a different remitter category over time. That matters for cash flow and compliance.

Fifth, make sure your payroll admin knows what to look for on pay stubs. If CPP2 is supposed to show up for certain employees after they cross the YMPE, it should be visible. If it never appears, that is a red flag worth investigating in March, not in December.

Common CPP2 errors that trigger penalties, rework, or employee frustration

When CPP2 payroll deductions 2026 go sideways, it usually shows up as one of these scenarios.

The first is simple: CPP2 is not withheld at all. This often happens after a payroll migration or when a software setting is not enabled. It can also happen when someone processes a manual cheque for a bonus and does not run it through the payroll engine that calculates CPP2.

The second is over-withholding: CPP2 continues after the annual maximum is reached. Employees notice this fast because they compare pay stubs, and then you are stuck explaining a correction. Over-withholding also creates year-end reconciliation work because your T4 totals need to match actual remitted amounts.

The third is “surprise CPP2” on irregular pays. Bonuses and retroactive payments can push an employee above the YMPE in one run. If your software does not handle caps properly, CPP2 payroll deductions 2026 can be miscalculated in that pay period and then “fixed” later in a way that confuses both the employee and your books.

The fourth is late remittances. CPP2 itself is not the reason a remittance is late, but increased withholding amounts can expose weak cash-flow routines. CRA lists payroll remittance due dates and when to remit source deductions, including the penalty risk if you miss the deadline.

If you are already operating close to the line on cash flow, higher payroll costs from CPP2 payroll deductions 2026 can make that stress show up earlier in the month.

The owner-manager angle: salary vs dividends through a CPP2 lens

Owner-managers often hear “dividends do not have CPP” and stop the conversation there. It is true that salary triggers CPP and CPP2, while dividends generally do not. But the decision is not only about CPP savings.

Salary can support RRSP contribution room, benefit planning, and a stronger “income history” for personal financing. Dividends can simplify payroll and reduce source deductions, but they can also create bigger instalment expectations and different personal tax timing.

From a business operations viewpoint, the key is to be intentional. If you plan to pay a salary that crosses the YMPE, then CPP2 payroll deductions 2026 should be part of your cash-flow plan and part of your payroll controls.

If you’re an owner-manager and you’re considering a different mix of pay, it’s worth reviewing the practical trade-offs before you change anything in payroll. Our guide on how to pay yourself as a small business owner (salary vs dividend vs year-end bonus) is a solid starting point, and then you can confirm the best approach for your situation with your tax advisor.

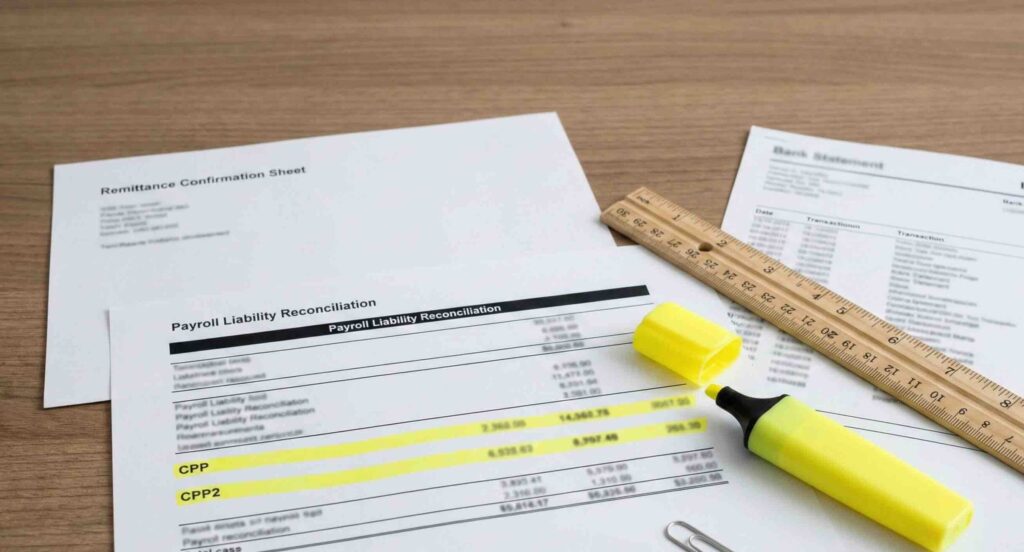

Practical controls that keep CPP2 clean all year

This is the part most decision makers appreciate because it is not theoretical. It is the small routine that avoids big cleanup.

Control one is a monthly “cap check” for higher earners. Pull a year-to-date payroll register and scan for employees nearing the CPP max and CPP2 max. If someone is within a pay or two of maxing out, you want to confirm the system will stop withholding automatically.

Control two is a bonus run checklist. Before you pay bonuses, confirm whether the bonus is pensionable and whether it will push any employee above the YMPE. If yes, confirm CPP2 payroll deductions 2026 will be calculated correctly in that run.

Control three is reconciliation discipline. After each remittance, reconcile the payroll liability accounts to the remittance confirmation. If CPP2 is separated in your system, confirm the totals make sense. If it is combined, confirm the overall CPP payable aligns with the payroll register.

Control four is year-end readiness. Many CPP2 issues are discovered during T4 preparation. That is late in the game. A quick pre-year-end review in October or November can catch missing CPP2 withholding while there is still time to correct smoothly.

If you want a structured way to run that review, use our year-end payroll checklist for BC employers as a guide before T4 season starts.

Employer checklist for CPP2 payroll deductions 2026

Use this checklist as your internal handoff between operations and payroll. It is designed to reduce rework, not create paperwork.

- Confirm payroll software is updated with 2026 CPP thresholds (YMPE $74,600 and YAMPE $85,000).

- Confirm CPP2 payroll deductions 2026 are enabled and calculated at 4% on the earnings slice between YMPE and YAMPE.

- Confirm CPP and CPP2 annual maximums are applied automatically and stop withholding when the cap is hit.

- Review earning codes to ensure pensionable earnings are coded correctly (wages, commissions, and applicable taxable benefits).

- Run a report of employees projected to exceed the YMPE and flag them for monthly cap checks.

- Review bonus and retro pay processes to ensure manual cheques are avoided or handled through the payroll engine.

- Verify pay stub format shows CPP and CPP2 clearly (or confirm where CPP2 is reported if combined).

- Confirm employer expense accounts and payroll liability accounts are mapped correctly in the general ledger.

- Reconcile payroll liabilities to remittance confirmations every remittance period, not only at month end.

- Confirm your remitter type and due dates based on AMWA and update calendar reminders for remittances.

- Do a mid-year audit of CPP2 payroll deductions 2026 for at least one high earner to confirm year-to-date tracking and caps.

- Do a pre-year-end review (October to November) so any required adjustments are handled before T4 season.

If your payroll is already stretched thin, this checklist is also a clean basis for outsourcing discussions. It helps you define what “done right” looks like.

Where CPP2 fits with the rest of your payroll compliance

CPP2 is only one piece of source deductions. If CPP2 is off, it is often a sign that other payroll settings may be off too, especially after software changes.

If you want a refresher on the bigger picture, start with our overview of payroll deductions in Canada to confirm what should be coming off each pay. CPP2 payroll deductions 2026 should be treated like part of a system, not a one-off calculation. And if you’re tightening up your process overall, here’s our step-by-step guide on how to run payroll in Canada so the routine stays consistent from pay run to remittance.

If you operate in hospitality, construction, or other industries with variable pay, the risk of crossing the YMPE mid-year is higher. In those cases, CPP2 tends to show up during peak season or bonus periods, which is exactly when admins have the least time to troubleshoot. Our restaurant payroll Canada compliance tips are a good reference point even if you’re not strictly in food service.

A quick reality check before you move on

Before you close this tab, do one quick mental test. Do you know which employees are likely to cross $74,600 in 2026?

If the answer is “not sure,” that is your cue to run a simple payroll report and identify who needs monitoring. CPP2 payroll deductions 2026 are easiest when you plan for them, and most painful when you discover them during a CRA notice or a T4 scramble.

Also, if you changed payroll providers recently or switched software, do not assume CPP2 carried over perfectly. Verify it. Payroll migrations are where we see the most “CPP2 was never turned on” problems.

At Valley Business Centre, we typically approach CPP2 like we approach bank reconciliations: you do not need to obsess over it daily, but you do need a steady routine that catches issues early.

At Valley Business Centre, we’ve supported businesses across Metro Vancouver, Whistler, Squamish, and the Sea to Sky Corridor for more than 30 years with bookkeeping, payroll, tax preparation, and cloud accounting systems. Learn more at Valley Business Centre.

If you’re a BC employer in Vancouver, Surrey, Burnaby, Richmond, Coquitlam, or North Vancouver and you want CPP2 payroll deductions 2026 set up properly without last minute stress, reach out. We can help you tighten up tracking for higher earners, reconcile deposits and remittance payouts, and keep payroll and bookkeeping aligned so year end feels straightforward instead of stressful.