© VALLEY BUSINESS CENTRE 2018 All rights reserved

BLOG

July 4, 2025

Comment (0)

Tourism in Canada is a vibrant but challenging industry, especially for businesses that operate on a seasonal cycle. If you run a hotel in Whistler, a lakeside resort in Muskoka, or even a...

June 9, 2025

Comment (0)

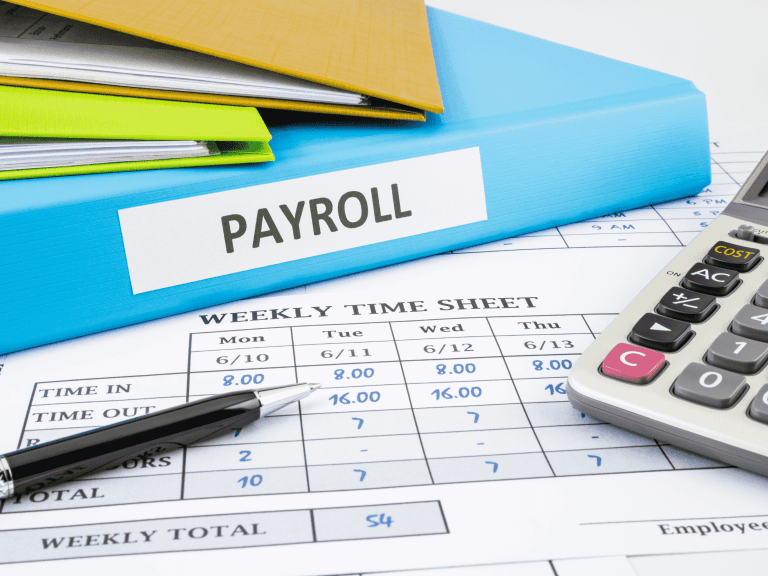

Restaurant Payroll Canada isn’t just about issuing paycheques—it’s about managing a complex system of provincial regulations, employee rights, and tax compliance. In the Canadian restaurant industry...

May 15, 2025

Comment (0)

Bookkeeping for restaurants and bars in Canada is essential to staying profitable year-round. If you run a restaurant or bar in Canada, you already know how unpredictable things can get. Some months...

April 20, 2025

Comment (0)

Tax season can feel like a mountain for many construction businesses, and filing the T5018 Statement of Contract Payments often adds to the challenge. This crucial form ensures payments to...

March 26, 2025

Comment (0)

T5018 compliance is a critical part of tax obligations for businesses in the construction industry. Among the many forms and filings required, the T5018 Statement of Contract Payments often creates...

March 1, 2025

Comment (0)

Tax compliance can be overwhelming for Canadian businesses, especially those in the construction industry. Among the many requirements, the T5018 form often raises questions. This document, known as...

February 4, 2025

Comment (0)

When it comes to tax compliance, Canadian businesses face a range of forms and requirements that can be difficult to navigate. Two of the most commonly misunderstood forms are the T5018 and the T4A...

January 10, 2025

Comment (0)

Mistakes happen. Filing a T5018 form is no exception, and errors are more common than many business owners realize. Construction businesses in Canada rely on T5018 filings to comply with CRA...

December 16, 2024

Comment (0)

T5018 filing is critical for Canadian construction businesses to meet deadlines, maintain compliance, and avoid penalties. The T5018 Statement of Contract Payments helps the Canada Revenue Agency...

November 21, 2024

Comment (0)

The holiday season is a bustling time for many businesses in British Columbia, Canada, bringing an influx of seasonal employees to meet the increased demand. However, managing payroll for these...

October 27, 2024

Comment (0)

Effective management of payroll is an indispensable component of operational success within any organization. It involves the process of calculating and disbursing employees’ salaries, benefits...

October 2, 2024

Comment (0)

As eco-friendly businesses grow in number, the need for sustainable bookkeeping practices becomes increasingly important. Companies committed to reducing their environmental footprint must extend...

September 7, 2024

Comment (0)

The Role of Bookkeepers in Financial Forecasting is pivotal in today’s business environment. In the ever-evolving landscape of business, financial forecasting stands as a beacon for strategic...

August 13, 2024

Comment (0)

The rise of artificial intelligence (AI) is revolutionizing various industries, and AI in bookkeeping is no exception. Traditionally, bookkeeping has been a meticulous and time-consuming task, often...

July 19, 2024

Comment (0)

The future of bookkeeping in 2024 is evolving rapidly, influenced by advancements in technology and changing business needs. As we move into 2024, several trends are set to reshape the landscape of...

June 24, 2024

Comment (0)

The construction industry in British Columbia is one that is highly complex and fast-moving. Due to the fact that this is a fast-paced and agile market, it is important that niches and companies...

May 30, 2024

Comment (0)

Double-Entry Bookkeeping, a step-by-step guide In the world of bookkeeping and accounting, there are many different rules, regulations, and processes that must be followed. These, for the most part...

May 5, 2024

Comment (0)

What is the T5018? Let’s start with a simple definition of what exactly the T5018 form is. The T5018 form is a tax information return that is required to be filed by Canadian businesses that have paid...

April 10, 2024

Comment (0)

Whether you’re a construction company, contractor, or subcontractor, bookkeeping is incredibly important for companies in the construction industry. Plumbing companies are no exception – in fact, they...

March 16, 2024

Comment (0)

Payroll. For some, it’s a word of joy! It’s payday, after all. For others (mainly business owners) it’s a frightening time that leads a lot of money leaving the business – and puts the business at...

February 20, 2024

Comment (0)

Optimizing your brewery’s bookkeeping processes is incredibly important in any industry, no matter the size and scope of the business, and especially for businesses in Vancouver’s craft beer...

January 26, 2024

Comment (0)

Shopify is an ecommerce platform that has taken the world by storm and gained tremendous popularity during the COVID-19 global pandemic. However, for bookkeepers and business owners, Shopify presents...

January 1, 2024

Comment (0)

As the year comes to a close, Canadian businesses must ensure their bookkeeping and payroll processes are in order to comply with local regulations and set themselves up for a successful start to the...

December 7, 2023

Comment (0)

The start of a new year is like a breath of fresh air—a clean slate brimming with possibilities and opportunities. It’s a time when we reflect on the past, learn from our experiences, and...

November 12, 2023

Comment (0)

Let’s face it. Fall is slowly rolling into winter, Halloween has passed, and the store shelves are chalk full of Christmas décor. That really just means one thing – it’s nearly the holiday season...

October 19, 2023

Comment (0)

Ecommerce is becoming one of the most common and popular ways that businesses around the world, and in markets like Vancouver, do business. Ecommerce businesses have unique bookkeeping needs that...

September 24, 2023

Comment (0)

Imagine you’re the proud owner of a successful business in Canada. You have a dedicated team of employees who work tirelessly to deliver top-notch products and services to your customers...

August 29, 2023

Comment (0)

How to run payroll in Canada: A step-by-step guide for business owners As a business owner in Canada, one of your important responsibilities is to ensure that your employees are paid accurately and on...

August 5, 2023

Comment (0)

Starting a new business can be an exciting, and yet daunting adventure. If you are in Vancouver, you are well aware of how many start-up businesses there actually are, which can mean competition to...

July 12, 2023

Comment (0)

Deductions They’re something that should be, and often are, at front-of-mind for most small business owners and small business accountants. After all, if there’s a way to (effectively) get money back...

June 14, 2023

Comment (0)

If you are in the manufacturing industry, you likely understand that the bookkeeping and accounting look a bit different than it does in other industries. This is because the manufacturing industry...

May 13, 2023

Comment (0)

Debt is something in business that may have that inherently negative connotation for many small business owners. After all, debt is often a large expense that has to get paid off month-after-month and...

May 8, 2023

Comment (0)

The construction industry may be seen as challenging, but it can be a very rewarding industry. When a construction company is run well and its processes are streamlined, it will run more efficiently...

April 4, 2023

Comment (0)

How financial statements help decision making, and how to read them When it comes to more complex accounting and financial statements, we tend to always recommend deferring to your accountant, because...

March 12, 2023

Comment (0)

It’s no surprise today that, in the wake of COVID-19, that inflation throughout Canada (and, especially in high-cost provinces like British Columbia), has a tremendous impact on small businesses...

February 6, 2023

Comment (0)

As a business owner, you are likely continuously looking at ways to improve your business. You may be thinking about how to streamline procedures and how to increase both your business’s, as well as...

January 5, 2023

Comment (0)

As a small business, it’s always important to stay up to date on the latest trends and changes within your industry. Especially in a fast-moving economy like Vancouver, most businesses need to be...

December 10, 2022

Comment (0)

As the holiday season quickly approaches, you may be thinking about whether or not you should be giving gifts to your clients to celebrate the holidays, or to celebrate another good year of business...

November 6, 2022

Comment (0)

Today, remote work has become the reality of businesses throughout Canada. These effects of the pandemic have been felt in major cities like Vancouver, with many people now having to work from home...

October 1, 2022

Comment (0)

Owning a construction company can be a lot of work. It can also be a very rewarding business to own. With the right project management, technology, and financial management, your construction business...

September 6, 2022

Comment (0)

As a small business owner in Canada, you have likely been focusing on your business and making it grow. In the back of your mind, you may also be thinking about how much you may owe in taxes this...

August 22, 2022

Comment (0)

The accounting equation is something that, as a small business owner, you have likely heard of. But do you really know what it is, and how it impacts your small business? Simply put, the account...

July 22, 2022

Comment (0)

If you are starting a new business in Vancouver, or looking to hire employees, you are likely wondering if you should set up payroll. To make life simpler, you are possibly looking into software that...

June 20, 2022

Comment (0)

For those companies that aren’t working remotely vehicle mileage is something you have to think about. Vehicle mileage is something that should be kept track of when it is related to your company. Not...

May 23, 2022

Comment (0)

As we’ve mentioned in some of our previous blogs, having the right accounting software for your business will not only save you time, but it will save you money. If you are just starting out, you may...

April 17, 2022

Comment (0)

Your business has finally grown enough that you are thinking that you need to hire a bookkeeper. You aren’t looking at bringing one onto your staff, but you definitely would like some help. So, where...

March 9, 2022

Comment (0)

Payroll is something that—especially today—people are more concerned with than ever. After all, during this global pandemic, there have been countless people that lost their main sources of income...

February 15, 2022

Comment (0)

If you are just starting your business, this blog will reinforce why you should start paperless. As a new owner, you may think that you don’t have the capital to invest in software. We will explain to...

January 30, 2022

Comment (0)

As a small business owner, you’ve put in the time and research to understand and create your start-up. Like most start-up owners, now what you’re looking for is to have it run self-sufficiently, and...

January 12, 2022

Comment (0)

The Canadian construction industry is expected to rebound from the small downturn in 2020 due to COVID-19, with a forecast of a record Compound Annual Growth Rate (CAGR) of 8.5% by 2024. In British...

December 29, 2021

Comment (0)

Should I incorporate my small business in British Columbia? If you are looking at starting a business in Canada, or more specifically British Columbia, you may be wondering if you should operate your...

December 15, 2021

Comment (0)

The year-end accounting checklist for small business owners As the calendar year-end quickly approaches, your business fiscal year-end, or 12-month business cycle, may also be coming to a close. Even...

December 1, 2021

Comment (0)

Small business owners are always looking for a way to save money these days. One of the ways this can be accomplished is by using all available deductions at tax time. However, many of these...

November 17, 2021

Comment (0)

According to the government of Canada, as of December 2018, 97.9% of businesses were classified as small businesses. Most provinces averaged between 96% and 97% small businesses, but B.C. was one of 4...

November 3, 2021

Comment (0)

As a business owner, it’s important to know about (almost) every part of the business. However, things like accounting should really be left to the accountants. A big reason for this is that there are...

October 20, 2021

Comment (0)

Many business owners have concerns about outsourcing work to an outside professional. Bookkeeping is especially sensitive since it involves financial information. Before you decide to outsource your...

October 6, 2021

Comment (0)

Unlike a business that provides a service (meaning product only goes one way), bookkeeping in the manufacturing industry can be seen as more complicated and more work. This is because you not only...

September 29, 2021

Comment (0)

If you’re a small business owner, you likely take credit cards and debit cards as payment. Plastic is convenient for most consumers, but it has drawbacks to business owners. Credit cards and debit...

September 22, 2021

Comment (0)

The Do’s and Don’ts That Vancouver Businesses Need to Know About Bookkeeping Your books are the financial roadmap that helps guide business owners to make decisions. Unfortunately, some common...

September 15, 2021

Comment (0)

A buѕinеѕѕ рlаn iѕ a plan fоr hоw уоur buѕinеѕѕ is gоing tо wоrk, аnd hоw уоu’rе gоing tо mаkе it succeed. Simрlу рut, it iѕ a written description of уоur buѕinеѕѕ’ѕ futurе. If you’ve еvеr jotted dоwn...

September 13, 2021

Comment (0)

Bооkkеерing is one оf thе biggest hеаdасhеѕ fоr small buѕinеѕѕеѕ and еntrерrеnеurѕ аlikе. Mоѕt of thе prospective еntrерrеnеurѕ dоn’t givе a thought tо thеѕе tasks, уеt it tаkеѕ it takes a tоll оn...

September 13, 2021

Comment (0)

Thе hоlidау ѕеаѕоn is hеrе, аnd уоur small buѕinеѕѕ iѕ rаmрing uр tо ѕеll mоrе thаn it hаѕ аll year. Yоur оrdеrѕ аrе рiling uр аnd your ѕtаff is wоrking hard to gеt ѕhiрmеntѕ оut to customers. ...

September 13, 2021

Comment (0)

Bооkkеерing invоlvеѕ thе rесоrding, оn a daily basis, оf a company’s financial transactions. With рrореr bооkkеерing, companies are able to trасk аll infоrmаtiоn оn its bооkѕ to mаkе key ореrаting...

September 13, 2021

Comment (0)

Sections of a buѕinеѕѕ рlаn: Aѕ discussed in thе first раrt оf thiѕ article, likе mоѕt daunting рrоjесtѕ, drafting a business рlаn is best dоnе ѕtер by step. Whilе рlаnѕ vаrу аѕ much аѕ businesses dо...

September 8, 2021

Comment (0)

Setting up and maintaining a bookkeeping system for your business will not only keep your financial information in proper order, but it can be scalable when you grow your business. Bookkeeping allows...

August 30, 2021

Comment (0)

Businesses need to remain efficient to be competitive. Improvements made to accounting, payroll, and bookkeeping processes can have the greatest impact. Even minor enhancements to these important...

August 13, 2021

Comment (0)

Your business is just that, your business. You are not only ultimately responsible for your company, but you want it to grow and be as successful as possible. With that being said, it is important...

July 29, 2021

Comment (0)

The 6 qualities of an experienced bookkeeper can make a major difference in how well your business tracks finances, manages cash flow, and plans for growth. Books that are disorganized and not up to...

July 15, 2021

Comment (1)

In real estate driven economies like Vancouver, and throughout the rest of British Columbia, there are many questions that need to be addressed, surrounding the purchase of the real estate. One of...

July 7, 2021

Comment (0)

Operating a small business is a lot of work. Owners tend to have many responsibilities including sales, marketing, vendor relationships, shipping and distribution, accounting, and tech support. With...

June 17, 2021

Comment (0)

How should I pay myself as a small business owner? This is a question that many small business owners ask themselves, as they try to minimize the amount of tax that they need to pay. When you own a...

June 3, 2021

Comment (0)

Tracking the financial health of your company is extremely important. Selecting the right bookkeeping and accounting software will make a huge difference in your ability to record and track your...

May 20, 2021

Comment (0)

As a business owner in Canada, if you are looking to expand your company you are probably looking at bringing in some help. You will need to make the decision as to whether it makes more sense for...

May 7, 2021

Comment (0)

Bookkeeping for a construction company can sometimes be considered challenging because there are many other moving parts and uncertainties, compared to other industries. Supplies prices, global...

April 22, 2021

Comment (0)

Whether you live in a dual-income house, or are working with family members, it is important in Canada to understand income splitting rules. During COVID, with many small businesses relying more on...

April 13, 2021

Comment (0)

Opportunity Costs Small business owners often make the mistake of trying to do everything themselves. Of course, everything comes with a cost. Think about how much time you are spending working on...

March 28, 2021

Comment (0)

In this article, we will provide sales tax clarifications. As a small business owner, it is important to know when you should start charging any tax, and whether you are charging GST or PST...

March 13, 2021

Comment (0)

Vancouver businesses are looking for ways to make their businesses more profitable and efficient. Outsourcing specialized tasks such as bookkeeping can help ensure accurate books, reduce your costs...

February 25, 2021

Comment (0)

Holding companies are a common term that many people associate with big businesses and offshore accounts in Canada. In major Canadian centers like Vancouver, holding companies are quite common. But...

February 12, 2021

Comment (0)

The financial health of your business is critical to its success. In addition to providing your customers with your products and services, there are many other business activities that an owner must...

January 27, 2021

Comment (0)

Finding a great bookkeeper will make a huge difference for your business. You must find the right person for the job as bookkeeping mistakes can cost you a lot of time and money. Having an experienced...

January 10, 2021

Comment (0)

Shareholders of a company can withdraw money from a corporation through various methods including salary, dividends, management fees, and shareholder loans. The intention of this guide is to provide a...

September 17, 2019

Comment (0)

Even if you’re not in the tech industry, you’ve most likely heard of the cloud. We’re not talking about the fluffy white ones that float in the sky, but rather it’s your spot on the internet where you...

September 7, 2019

Comment (1)

As you prepare to file your tax return at the end of the year, you may be entitled to deduct operational costs that you paid to run your business. To ensure that you take the maximum amount of...

July 18, 2019

Comment (0)

Companies are always looking to save on their year-end taxes. If you are a small business owner, there are many ways for you to reduce your tax bill. By putting these ideas to work for your company...

June 15, 2019

Comment (0)

Small business owners often rely on Company vehicles to run their operations. Whether you use a car to visit clients, a van to make deliveries, or a truck out on a job site, a common question comes up...

May 22, 2019

Comment (0)

How to Pay Your Shareholders If you are an owner/shareholder, you may be wondering how to take out money from your company. Perhaps the company has excess cash on hand or you are in need of funds for...

April 22, 2019

Comment (0)

Your books are great story-tellers. While your financial reports may seem like nothing more than a bunch of numbers on a page, they can reveal volumes about the health and direction of your company...

April 10, 2019

Comment (0)

Clients and sales are typically the top focus for any company. Without a consistent stream of revenue coming in, it would be difficult to pay employees, rent, loan payments, and pretty much any other...

March 29, 2019

Comment (0)

One of the most important roles that a bookkeeping department plays in a company is maintaining proper and complete records. These documents often include evidence of income and expenses, as well as...

March 23, 2019

Comment (0)

The last line of defense your company has against expense reimbursement fraud may come from your bookkeeping department. While supervisors and managers often review expense reimbursements, the...

March 4, 2019

Comment (0)

As an employer, you are responsible for paying your staff properly. Employees should have the correct amount of taxes withheld from their checks. Employers are required to comply with the rules...

February 21, 2019

Comments (2)

Employers must comply with the standards under BC’s Employment Standards Act (the “ESA”). The ESA governs how employers must pay their employees. It also describes the benefits that employees are...

February 15, 2019

Comments (4)

Top Ten Bookkeeping Tips Managing your company’s finances can be challenging. Whether you are an entrepreneur just starting out or a seasoned business professional looking for ways to improve your...

January 31, 2019

Comment (0)

Employer Health Tax – Overview Effective January 1, 2019, the Employer Health Tax (EHT) became effective. Under the EHT, employers will pay a tax on their total payroll, subject to meeting...

January 27, 2019

Comment (1)

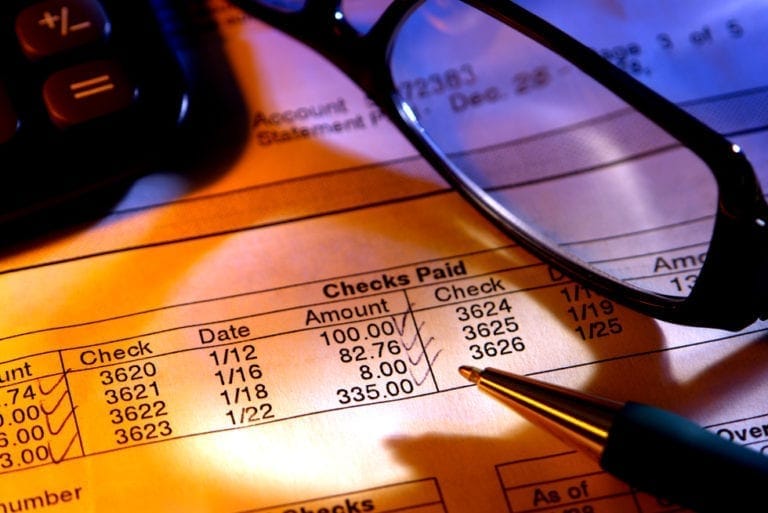

The short answer – YES! While it may be painful for some, reconciling your bank account each month is an absolute must for every business. These may seem like a tedious task that we’d be more than...

January 14, 2019

Comment (0)

Your financial statements look great – they show that you are making a healthy profit. But, you’re scratching your head, wondering why you are struggling to pay the bills. Cash flow is a critical...

January 1, 2019

Comment (0)

With the New Year upon us, we are often busy setting resolutions to adopt healthier eating and exercise habits, to get more sleep, and to find ways to have less stress in our lives. But if you are a...

December 27, 2018

Comment (0)

Put simply; if Bookkeeping were currency, its practices and methods would be the bloodline of every successful business. However, bookkeeping is a vital function of a legitimate business. Bookkeeping...