The short answer – YES! While it may be painful for some, reconciling your bank account each month is an absolute must for every business. These may seem like a tedious task that we’d be more than happy to put off to another time, reconciling your business bank account each month gives you not only a powerful tool to run your business, it also helps you catch problems and keep you from bouncing a check.

What is a bank reconciliation?

A bank reconciliation involves comparing what happened in your bank account with what you have recorded in your books and records. Once they are completed, the balance in your books should reconcile to what cleared on your bank statement. Bank reconciliations can often be done within your bookkeeping software, on paper, or you may have a bookkeeping service prepare this for you each month.

How do you prepare a bank reconciliation?

To complete a bank reconciliation, you’ll perform the following steps:

- First, you’ll compare what has cleared on your bank statement against what you have recorded in your books. This step requires you to check off those items in your books that have cleared.

Your bank statement may have interest income or service fees that you will need to record on your books. You will then check off as well since they cleared your account.

- Next, you’ll review those items that you didn’t check off. If you made a deposit on the last day of the month, it may not have cleared until the next month. These are known as deposits in transit. When you reconcile your bank statement in the following month, you should expect to see these items clear your account.

Checks that were written in the month, but have not yet cleared are considered outstanding.

In this step, you’ll want to review deposits in transit and outstanding checks for anything that is old and hasn’t cleared. If it’s a deposit in transit, it could be a duplicate entry or perhaps the deposit was not made. Old outstanding checks could indicate that a check you mailed was lost or perhaps it should be voided.

So how does this all fit together?

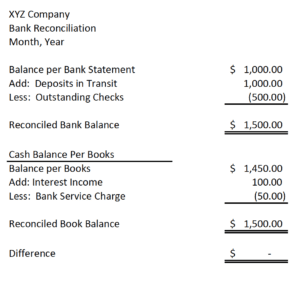

• The last step involves comparing your reconciled bank statement balance with the cash balance on your books. A simple bank reconciliation may look something like this:

A bank reconciliation will typically start with the bank statement balance. Deposits that were made in the month that haven’t cleared will be added to the bank statement balance, whereas checks that were issued but haven’t cleared will be subtracted. This will yield the Reconciled Bank Balance.

The next step is to start with the cash balance on your books and add any income and deduct any charges that have not been recorded.

Once both steps have been completed.

A successful bank reconciliation will show no difference between your reconciled bank balance and your reconciled book balance.

If they aren’t the same, you have some additional work to do. A few suggestions to resolve the differences include reviewing what you’ve checked off as clearing the bank statement, verify that there aren’t any other charges or credits that have been reflected on your bank statement that are not on your books, and double check the items that are showing up as deposits in transit or outstanding checks. Continue this process until you find the difference.

Top 4 Reasons to Reconcile Your Bank Account Every Month

Reconciling your bank accounts each month can serve as a valuable tool for you to monitor your business.

Catch Mistakes

By comparing your bank statement with your records, you can catch errors made. Missing transactions, transposition errors, or adding an extra number by accident can cause the cash balance on your books to be too high or too low. A big mistake can be a problem, especially since you may be issuing checks when you may not have as much money in your account as you think. This can prevent the embarrassment of receiving a phone call from a vendor because your check was returned due to insufficient funds.

Save Money

There is something about looking at all of the fees that you pay in one place that tends to points our minds in the direction of – do we really need to pay for that each month? You may question the need for all of the monthly subscriptions coming out of your account. Perhaps you weren’t even aware that you were being charged. Reconciling your bank account each month is critical – if you allow too many months to go by, you may not be able to request a refund. It may also be an opportunity to speak with your banking representative to see if there are options for lowering bank service charges or transaction fees.

Checks Not Cleared

Typically, checks that are issued will clear within a few weeks. When a check hasn’t cleared on two of your bank statements, there may be something wrong. Perhaps it was lost in the mail or the vendor just forgot to deposit it. Either way, this could spell trouble for your business, especially if you purchase goods on credit. This gives you the opportunity to check in with your vendor. You may find that they changed their mailing address or very behind in their own bookkeeping. Being proactive in this front can save you a lot of headache as you may be on credit-hold and not even know it.

Fraudulent Transactions

Reconciling your bank account can help you to catch transactions that you didn’t authorize or have been altered. Your bank account may have been used to pay someone else’s bills online or perhaps a check amount was changed by an employee or vendor. Fraudulent transactions can add up over time and cost you a lot of money if they aren’t caught early.

If you have an in-house bookkeeper handle deposits, paying bills, and recording transactions, a best practice would be to have someone else reconcile your bank account if possible. In a small business, an owner may reconcile the accounts or you may choose to engage a bookkeeping service. While this may cost you a little money each month, it can potentially save you thousands of dollars if errors or fraudulent transactions are taking place.

What Should You Do?

Reconcile your bank account every month. If you don’t have the time or if you’d just like the comfort of another set of eyes looking at your records each month, consider hiring a bookkeeping firm to take on this function. For almost 20 years, the team at Valley Business Centre has delivered high-quality bookkeeping and payroll services. Serving clients in Whistler, Squamish, the Sea to the Sky corridor, BC, and beyond, our bookkeeping specialists have consistently delivered accurate and reliable bookkeeping and payroll services that can give you peace of mind.

Hіցhly descriptive post, I enjoyed that bit. Will there

be a part 2?