The accounting equation is something that, as a small business owner, you have likely heard of.

But do you really know what it is, and how it impacts your small business?

Simply put, the account equation is the foundation of bookkeeping and accounting that is completed for your small business. Since it is the foundation of all things accounting in your business, it has a significant impact on your small business, that we’ll get more into in this blog.

What is the accounting equation?

When your bookkeeper references the accounting equation, they are simply talking about the representation between your assets, liabilities and the equity within your business.

The accounting equation shows you as the business owner, what they are referring to when they tell you that every transaction will have a dual effect on your financial statements. This can also be referred to as double-entry bookkeeping. Basically, this is how your books are balanced.

More simply stated, every entry into an account requires a corresponding, yet opposite, entry to a different account. This means that one entry, on the left side of the equation is a debit, and the other entry on the right side of the equation, is a credit.

Again, the left is a debit, and the right is a credit.

This may seem backwards or even a bit confusing at first. For you as a business owner, you simply need to understand that your debits need to, and will equal, your credits.

What the accounting equation looks like in its most common form is this:

What the accounting equation looks like in its most common form is this:

Let’s talk about an example.

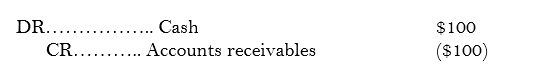

Assume that you got paid cash for an outstanding invoice. That invoice would be recorded as an “Accounts Receivable”, and the cash would be… well, cash.

The proper entry using the accounting equation would be an increase, or debit, to your cash account, and a decrease, or credit, to your accounts receivables. This is because your accounts receivables have now decrease by the amount of cash you just got paid.

This may look something like this:

You can see in this that the net value of this transaction is zero because your debits and credits are equal and opposite to one another.

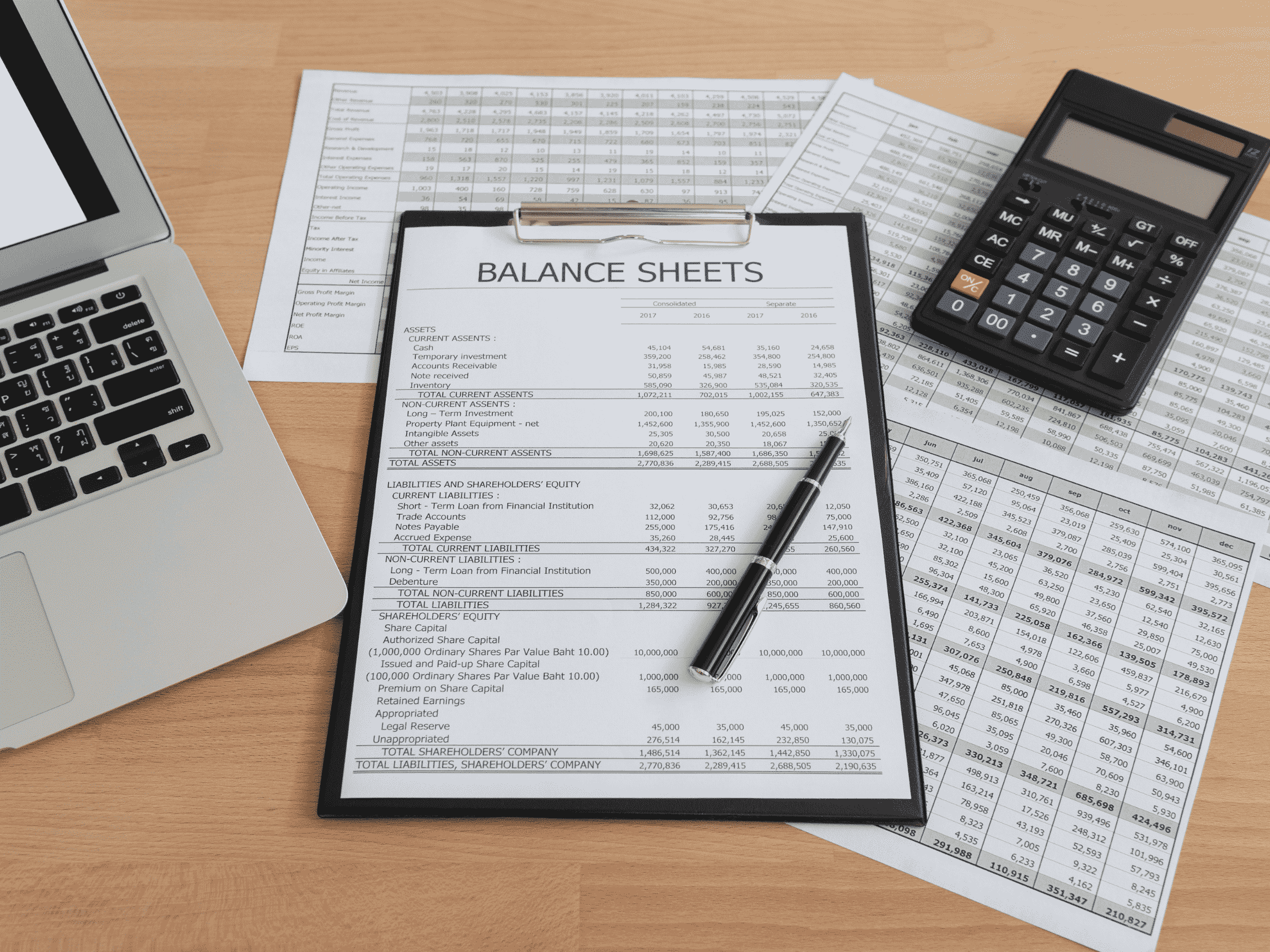

This format also reflects what you will see on your financial statements, more specifically, your balance sheet.

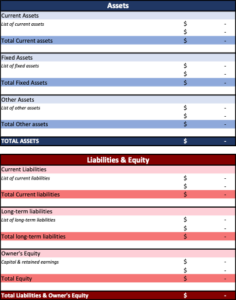

It will display your assets to you first, followed by your equity and liabilities below. Your total liabilities and equity will equal to your total assets. If these numbers are equal, you know your accounting equation has been applied currently, and your books are balanced. If not, then something is wrong that you’ll need to revisit.

Let’s take a look at the simplified balance sheet template below.

This is a simplified version of what a balance sheet may look like. In reality, it may be further broken down into current and fixed assets, current and fixed liabilities, and what form your equity is in.

Under each category, you will place the total value of each category, according to your ledgers.

If your business has gone paperless and you are running your bookkeeping and accounting through accounting software, this equation will be built in, and it will reject and entries that do not balance according to this equation.

Even though accounting software will make this much easier for you, it is still important to know what is going on behind the scenes with the accounting equation—and how it ultimately impacts your business.

So, let’s break down each of the components.

Assets

When you look at the assets of your business, you are looking at anything that has value in your company.

Your assets will include your accounts receivable (or the money owed to you by your customers), any cash that your business has is in the bank, the cash value of your inventory (if you carry an inventory), any real estate or properties, and any equipment that your business may own.

Essentially, your assets are anything that can be turned into cash or have a positive cash value. These assets can be further broken down into current assets and fixed assets.

Your business’s current assets include not only the cash that your business holds in the bank, but also anything that can be converted to cash within one year. As an example, this would include any inventory that your business may hold.

At the end of the day, you can sell this inventory, which will earn you cash. Simple.

Fixed assets on the other hand, include items that are typically harder to convert to cash and may take longer than a year to convert. This could include any real estate holdings or intangible assets.

Intangible assets are assets that don’t have any physical substance to them. This can include intellectual property, such as patents or trademarks, or other assets such as software or licenses.

Although these things like property, goodwill, investments, and other long-term (fixed) assets may not have cash value today for your business, they still have a positive impact on your business in the long run.

Equity

When you look at the equity that you have in your business, it is important to remember that this includes more than just capital.

The capital in your business may be referred to as the original investment that you made into your company, or what may remain from the original investment.

Equity also includes retained earnings, which is any profits that your business has accumulated and held onto, within your business.

Finally, equity can include preferred stock. Preferred stock is similar to regular stock, but it provides some protection from shareholders as well as giving the business owner priority when it comes to distributing dividend payments.

Liabilities

Your business liabilities include any debt that your business may owe and has yet to pay for.

Your business’s liabilities can include any bank loans, wages or salaries payable, and your accounts payable.

The business accounts payable can include any money that you may owe to any of your suppliers or sub-contractors. Similar to assets, liabilities can be broken down into current liabilities and fixed liabilities.

Your business’s current liabilities are any debts that are expected to be paid off within the next year. This would include any of the accounts payable mentioned above as well as the current year’s salaries or wages.

The business’s fixed liabilities could include any debts that will take more than one year to pay off, and typically include any bank loans or long-term lease obligations.

The Accounting Equation

As mentioned above, the accounting equation is key to understanding your business finances. In its most basic form, you will realize that when your assets increase, your equity will increase too. Yet when you add to your liabilities, even though your equity will decrease, they will both still be equal to your assets.

Let’s look at an example:

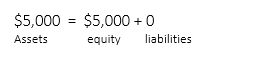

Say that you have finally decided to open your dream coffee business, and you that you are going to invest the $5,000.00 in capital that you have been saving up.

Looking at the accounting equation, and knowing that the 2 sides will be equal, it will look like this.

Looking at the accounting equation, and knowing that the 2 sides will be equal, it will look like this.

You can see that the assets in your new coffee business are $5,000. Your equity in your business is also $5,000 since there are $0 liabilities to date.

So far, the accounting equation is still equal, because your assets are equal to the sum of your equity and liabilities.

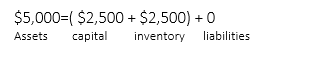

Now let’s say that you have taken $2,500 of your investment, and you have now purchased what is going to be your initial inventory of coffee beans.

What are your assets going to be?

They are still going to be $5,000.00, because inventory is counted as an asset.

It is the other side of the accounting equation that will now look different. It will now read, this:

Your business still has $5,000 in assets, but $2,500 has now been moved into inventory with $2,500 remaining as capital. At this time your liabilities are still $0. We are simply expanding the equity portion of the equation to provide you, the owner, a more informative equation to look at, so that you can see exactly where your money is.

But how does this accounting equation impact your business?

It shows you on one hand exactly where your money is. That is, you know that you have a total asset value of $5,000. So, the accounting equation shows you how that $5,000 is broken down on the other side of the equation, so you can see the relationship between your assets, liabilities, and equity.

This can help you understand areas of your business that may be struggling, or adding financial burden (or benefit) to your business.

As another example,

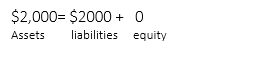

You have gone to your bank with an impressive business plan, but you don’t have any capital of your own to invest in the new business. The plan was so great, the bank decided to lend you $2,000 to start your business.

This loan is a liability, since it is something that your business is now going to need to repay. It is also an asset though, because you now have $2,000 to get your new business going.

Since we use double-entry accounting to keep our books balanced, our equation will look like this:

As we noted after the first example, parts of the accounting equation can be broken down further, to provide you with more details.

In that example, we showed you that-

Assets = (capital + inventory) + liabilities

The accounting equation can be further broken down to look like,

![]()

Revenue is simply what your business has been earning throughout its operations, while your expenses are the costs that your business is incurring while you are operating.

Owner draws speak for itself. This is the money that you have decided to withdraw from your business. When you do decide to pull this money out from your business, your balance sheet will show you that you have caused a reduction in your capital.

As a business owner, you may ask why the accounting equation matters to you. Simply put, it provides a better picture of your business finances not only for you, as the owner, but also for any outside investors or banks. The accounting equation can also provide the basis for, and allow you to create projections for your business. For example, it will allow you to see if you are able to purchase the new equipment that you have been looking at.

It will also ensure that your balance sheet is, well… balanced!

Need help from an expert?

We understand that double-entry bookkeeping and the accounting equation can seem a bit confusing. Let one of our experts at Valley Business Centre help. For over 30 years, Valley Business Centre has been providing comprehensive bookkeeping, payroll and tax services to our clients in Whistler, Squamish, the Sea to Sky Corridor and metro Vancouver B.C. areas. Valley Business Centre provides reliable and effective services to all clients.

Disclaimer

This article is written for informational purposes only. It is current at the date of posting and changes to laws and regulation may result in the information becoming outdated. It is not intended to provide legal, tax, or financial advice. It is recommended that readers get advice from a tax professional before making any final decisions.