If you are starting a new business in Vancouver, or looking to hire employees, you are likely wondering if you should set up payroll. To make life simpler, you are possibly looking into software that can take care of your payroll for you, even with the assistance of a bookkeeper.

Not only does payroll software streamline and automate the process for you, it will save you time and will reduce the chances of manual payroll errors. Payroll can be a time- consuming process, and it needs to be done not only consistently, but with accuracy. Not only that, but once you have paid your employees, then you are faced with sending in remittances. This can all be simplified by using payroll software.

If you are looking to set up payroll services for your small business based out of Vancouver, you may not be sure what is best for you. There are also a lot of options. Some programs offer payroll only, and for a few employees. Other payroll programs offer that as well as human resources and year-end statements, and others offer that and everything in between with tier programs.

We would like to offer a few suggestions, starting with some key services that a payroll program should provide to you.

A payroll system can put processes in place to keep track of the hours that your employees have worked. This can then calculate their wage, and then it will also deduct what is necessary from your employee’s pay-cheque. This may include taxes, as well as CPP and EI. As well, it can generate pay stubs that are accurate for you employees to view. Some will even allow them to do this through an app.

A payroll program may even be able to calculate various employee expenses, holiday pay and even bonuses. Software programs can do this with far less effort and likely more accuracy than it would take for someone to do this by hand.

Even more, you likely would also want this payroll service to remit any payments directly to the federal and provincial governments. This last step is equally important, because if payments aren’t remitted in time, you will pay interest.

Sticking with the topic of tax, you may also want your payroll service to not only create your year-end T4s, but also to generate records and financial statements, which would include your year-end tax documents. This will simplify processes for your business at year-end.

Of course, you likely also want this payroll service to not only pay your employees through direct deposit, but if it isn’t part of your accounting software you definitely want it to be able to sync with your accounting software.

One of the benefits that you may not think about includes the morale of your employees. When you staff know that the payroll is done consistently on time, and they can access their own information can add to their confidence in the company. It will also keep track of their time, or attendance for the business.

There are many different payroll solutions that are available to you, and you may want to check in with your bookkeeper to see which ones they work with, as well as what works best for your business.

Here we want to expand on some of the more popular payroll software programs.

Ceridan Dayforce

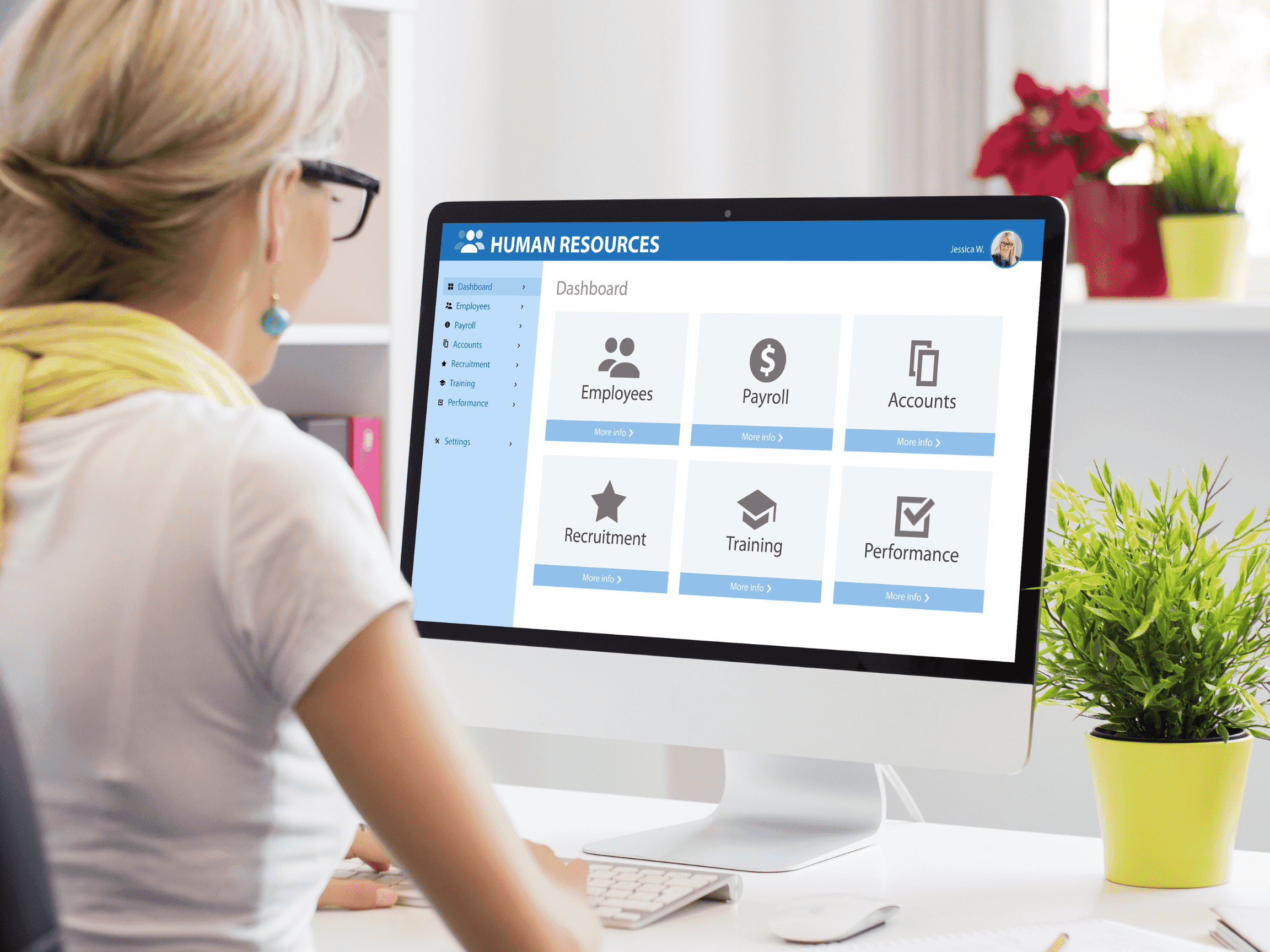

This platform is one of the larger payroll providers. Dayforce offers not only payroll, but it includes human resources (HR), benefits, workforce management and even talent management on one platform.

This means that if you’re just starting your business, or are looking to transition and centralize your software for your Vancouver business—this could be the best option.

This software offers its users a mobile app. As a business owner, you may find that you don’t always have time to sit in your office. This software program allows you to access your payroll from wherever you are at.

It also allows your employees access to the self-service features. Meaning they can view their pay-cheque breakdown, pay stubs and even print out their own tax forms.

This software also allows you to scale and modify what it does for you, as your business grows.

On the downside, because it offers so many features, it may be challenging to navigate if you aren’t tech savvy.

But, if you’re able to hire a local bookkeeper in Vancouver, or if you’re a tech savvy businessperson that doesn’t mind a bit of a learning curve, then this is the program for you.

Wagepoint

This is another cloud-based software program for Vancouver’s small businesses to access. They have a straightforward pricing system, which is based upon how many employees you are paying and how often.

Some of its features include direct deposit, online paystubs, tax filings, and year-end reporting. It can also take care of the stat holiday calculations for you.

It has a user-friendly design, which is great since as a small business owner, you may not have a lot of experience dealing with payroll.

With the focus on payroll, it automates not only CRA remittances, but WCB as well.

One of its weaknesses is, if your business runs additional payrolls, this may end up not being the most cost-effective program for you. They also don’t offer a lot of phone support if this is important. However, once again, if you’re looking for a more autonomous software for your business, then this shouldn’t be a problem.

As well, it doesn’t offer a lot of human resource solutions such as performance reviews. It also lacks in some benefits features, and you would need to purchase additional HR software if you are looking for that.

In short – this is a very straightforward account that is great for Vancouver businesses that like to run the show a bit more.

Wave Payroll

This company offers you a user-friendly, modern interface. While they do offer some of their services for free, payroll services are a paid service.

Its dashboard provides a comprehensive overview of everything that you will need to review, edit and approve before you run your payroll.

Wave also allows for integration between your payroll, invoicing as well as your businesses accounting. This means that you can sync your employee information and keep all of your financial information in one place.

Its pricing structure makes it ideal for your small Vancouver business.

Though this may be great for your small business, it may not scale well as it now stands. It does not allow you to have multiple users, and if you need to add commission to your employee’s salary, is not a smooth process.

As well, it also lacks HR and benefit, meaning if you want to deal with HR, you will need to purchase HR software as well. It also isn’t very comprehensive when it comes to features, and reporting is limited.

Thus, this is the option for those businesses looking for a more cost-effective and simple platform.

Gusto

Gusto has a payroll system that is set up for small businesses that are starting out as well as growing. In addition to payroll, Gusto offers other HR features such as benefits, hiring and management resources. The Gusto app also allows for your employees to access their paystub details.

As with other payroll programs, Gusto offers different tiers to its customers. Its Core plan offers payroll processing and the supporting records and tools, and they go up to the Complete tier, which adds more HR tools, including hiring and onboarding, as well as time tracking and project management.

It really depends on how much you are wanting to spend, and the features that are important to your business.

A few of the cons for this payroll software is that some screens have been found to load slowly. As well, if you want features such as time tracking, you have to move to a higher package than the Core plan.

With app integrations, this is great for businesses that are looking to get started with a more integrated software for their payroll services.

QuickBooks

What would an accounting software blog be without mentioning Quickbooks?

This is a name that many have likely heard of, and QuickBooks Standard payroll integrates with their accounting platform which is great for a small business. It also tends to be popular with many bookkeepers.

Like other cloud-based platforms, it can be accessed from anywhere. QuickBooks Standard doesn’t have a lot of the fancy add-ons, but it does help small businesses manage their payroll and it is popular not only among small business owners, but their bookkeepers as well.

A downside though, is that it doesn’t automatically file or remit your payroll taxes with the CRA. If you were to invest in QuickBooks Online Advanced Payroll, which is more expensive, this feature would be covered.

Though since your bookkeeper may work with QuickBooks, your business may choose to have them handle this for you until they recommend you upgrade.

As well, customer service is not always highly rated with it being a larger company. As with most though, they do roll out changes and new features for its users.

Nevertheless, if you’re just getting started, or just don’t know where to start with your payroll software for your Vancouver business, then Quickbooks is a great (and affordable) place to start.

Payroll software programs are constantly evolving, not only in the various features that they provide, but in their cost. As a business owner, you need to know what features are important to your business, now- and in the future. This can assist you in choosing the program that is best suited to your business.

What about the learning curve? We always suggest that if you’re ever uncertain about payroll, how to use payroll software, or which payroll software to use, it’s best to hire and work with a bookkeeper.

They often have great experience with a wide range of payroll and accounting software, and can get you the answers you need.

Need help from an expert?

We know that the payroll software market can seem overwhelming. Let one of our experts at Valley Business Centre help. For over 30 years, Valley Business Centre has been providing comprehensive bookkeeping, payroll and tax services to our clients in Whistler, Squamish, the Sea to Sky Corridor and metro Vancouver B.C. areas. Valley Business Centre provides reliable and effective services to all clients.

Disclaimer

This article is written for informational purposes only. It is current at the date of posting and changes to laws and regulation may result in the information becoming outdated. It is not intended to provide legal, tax, or financial advice. It is recommended that readers get advice from a tax professional before making any final decisions.