For those companies that aren’t working remotely vehicle mileage is something you have to think about.

Vehicle mileage is something that should be kept track of when it is related to your company. Not only can this be a valuable deduction for your business at tax time, but your employees will also appreciate being reimbursed when they are using their own vehicle.

The Canada Revenue Agency does not consider driving from home to your place of work as a business expense, so this cannot be included in the mileage. This is considered a personal expense. What they do consider a business expense, is any mileage that adds up from driving to meet clients, conventions or similar events, as well as any business-related travel.

When looking at vehicle mileage reimbursement, the Canada Revenue Agency has guidelines as to what they deem appropriate.

What the CRA considers reasonable for an allowance per kilometer driven is stated in section 7306 of the Income Tax Regulation.

Currently in 2021, the prescribed rate is $0.59 for the first 5,000 kilometer driven within the year. If there are any km driven above 5,000, the employee can be reimbursed $0.53 per kilometer. This rate applies to British Columbia and most of Canada, with the exception of the Northwest Territories, Yukon and Nunavut. They are provided with an additional 4 cents per kilometer travelled.

This rate is not only considered coverage for fuel, but any wear-and-tear on the vehicle.

As a note under the reasonable per-kilometer allowance, the Canada Revenue Agency states, “the amounts prescribed in section 7306 are to be used as a guide. A reasonable per-kilometer allowance can be either reasonably over or reasonably under those amounts”.

The thing to note is that the Canada Revenue Agency is all about making deductions “reasonable”.

Canada Revenue states that an allowance is reasonable if it meets the following three conditions:

- The allowance is based only on the number of business kilometers driven in a year,

- The rate per kilometer is reasonable, and

- You haven’t reimbursed the employee for vehicle expense related to the same use of the vehicle.

These reasonable allowances, which then become reimbursements, are not included in the employee’s income. As well, when the mileage is considered reasonable and is reimbursed, income tax, CPP and EI will not be deducted.

If you choose to reimburse your employee outside of these guidelines, or even at their recommendations, make sure that you have an agreed upon dollar value with your employee.

As well, for other amounts to be considered reasonable, they must be supported by fact.

So, keep your gas receipts or track your mileage on your company or personal vehicles.

It is recommended that you speak with your bookkeeper if you decide to vary from the above noted rates so that they can assist you in determining what is reasonable for your business.

When you reimburse your employee for their mileage, they not only need to provide you with receipts for the fuel purchases, but they also need to provide you with a log of their mileage.

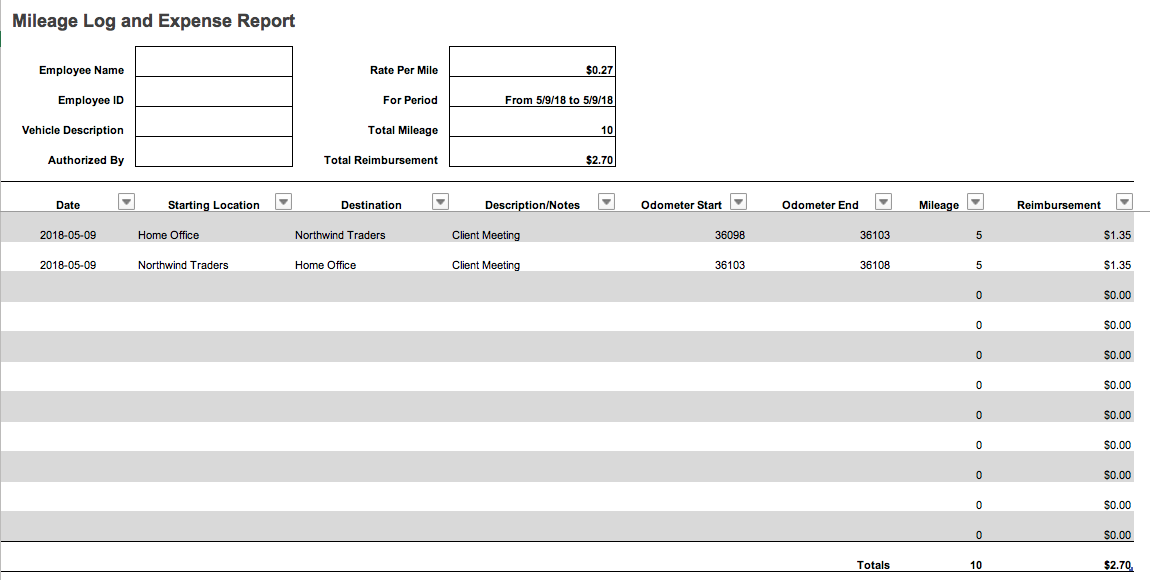

Below is a sample of what is included in a mileage log:

The information that you are looking to capture with a mileage log includes the date, the start and end locations and the purpose of the trip. As well, your employee needs to include the starting and ending odometer reading (to attain the kilometers driven) as well as the reimbursement amount.

As discussed in our blog, ‘Why going paperless will set your business up for success’, small businesses are going paperless, if they aren’t paperless already.

With that being said, your company may already have a software program that can track your employee’s mileage, such as the QuickBooks mileage tracker. This mobile app can make tracking mileage much easier, and it doesn’t rely on an employee remembering what their mileage was if they forgot to write it down. As well, a mileage app may even be able to communicate directly with your online bookkeeping program.

No matter which way you keep track of mileage, it is very important that you have the employee keep a log, separating personal and business use of their vehicle. If your company is ever audited, you will need to prove the expense, and that it was only for business driving.

Also remember to have your employee submit the log on a consistent basis that you have agreed to, whether that be day, weekly or by pay period.

As a business owner, you can choose to pay your employee a flat-rate allowance rather than a mileage allowance. A flat-rate allowance is the payment that you would provide to your employee for using their own vehicle in connection to work, without having to account for it.

This means that it is not related to the number of kilometers driven and it is paid to your employee in addition to their wage or salary. This is considered to be a taxable benefit though, as it is included in your employee’s income.

In turn, the employee may be able to claim allowable employment expenses on their return.

This allowance would also need to be deemed ‘reasonable’ by the Canada Revenue Agency.

Another option that you may choose, is to pay your employee a vehicle allowance that is a combination of the reasonable per- kilometer allowance and the flat-rate allowance for the same use of the vehicle.

This combined allowance is also considered to be a taxable benefit, meaning that it is included in the employee’s income. Again, they may be able to claim the allowable employment expenses notes above.

When looking at the above options, there are a few other things to consider. When looking at the mileage reimbursement, remember that is a deductible business expense for you company. This may make more sense for you rather than increasing their wages through a flat-rate allowance. If you choose a flat-rate allowance, you will also be dealing with any payroll taxes, CPP and EI on this increase in salary.

On the other hand, it may be more practical for your business to reimburse your employees for using their own vehicle compared to having a fleet of company owned vehicles that you allow your employees use.

Not only will you not have to spend your business’s capital on vehicles, you will not have to deal with the depreciation of a company asset. Even if you choose to lease vehicles, this will still be an added cost for your business. Perhaps you could be using this capital elsewhere.

As well, your business will not be responsible for the time it takes to maintain and repair vehicles. You also will not have the added cost of insuring the vehicles, which will be a blessing if your employees don’t have a stellar driving history.

Your employees may also see this as a preferred method, as they may see this as extra money each month that they can save for vehicle maintenance or upgrades. This may be especially true if they aren’t consistently driving a lot, or if they have an exceptionally fuel-efficient car.

Again, we suggest that you speak with your bookkeeper to determine which option is best for your business.

As a business owner, you may choose to reimburse your employee, or you may decide to provide them with and advance for their travel.

An advance is the amount of money that you provide to your employee in anticipation of expenses that they will incur for your business. If you provide them with an accountable advance, this means that they not only need to produce receipts for any money spent, but they are responsible to return any monies that they did not spend.

For example, if you are sending your employee to Kamloops, BC to attend a business function for the day, you may provide them with an advance in consideration of the fuel it will take them to get there. When your employee returns, they will provide you with a vehicle log of the kilometers driven, as well as any receipts for the fuel.

Based upon the reasonable per kilometer rate, this is then deducted from the advance. If they have exceeded the value of the advance, then you would reimburse your employee for the additional amount. Again, this is not considered a taxable benefit it the above conditions have been met.

Again, make sure that you have discussed all of this with your employees at the beginning, so that they understand what your company policy is and so that they are aware of required mileage logs, frequency and so on.

Need help from an expert?

Understanding which method of mileage reimbursement for your employees can see daunting. Let one of our experts at Valley Business Centre help. For over 30 years, Valley Business Centre has been providing comprehensive bookkeeping, payroll and tax services to our clients in Whistler, Squamish, the Sea to Sky Corridor and metro Vancouver B.C. areas. Valley Business Centre provides reliable and effective services to all clients.

Disclaimer

This article is written for informational purposes only. It is current at the date of posting and changes to laws and regulation may result in the information becoming outdated. It is not intended to provide legal, tax, or financial advice. It is recommended that readers get advice from a tax professional before making any final decisions.