What is the T5018?

Let’s start with a simple definition of what exactly the T5018 form is.

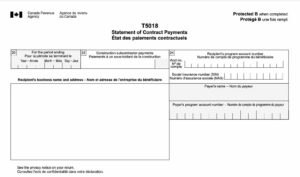

The T5018 form is a tax information return that is required to be filed by Canadian businesses that have paid contractors for construction services.

The form is used to report payments made to subcontractors for construction services during the fiscal year, and it provides information about the subcontractors and the services they provided.

The T5018 form is a part of the Canada Revenue Agency’s (CRA) efforts to reduce the underground economy by requiring businesses to report payments made to subcontractors for construction services.

The CRA uses the information provided on the T5018 form to ensure that subcontractors are reporting their income correctly and paying their fair share of taxes.

In other words, it requires businesses to provide detailed information about each subcontractor, including their name, address, business number, and the total amount paid for construction services.

The form must be filed annually by the last day of February following the end of the fiscal year, and failure to file the form can result in penalties and interest charges.

Overall, the T5018 form is an important part of the Canadian tax system, as it helps to ensure that all businesses and subcontractors are paying their fair share of taxes and operating within the law.

So… Exactly who uses this form?

In Canada, businesses that have paid subcontractors for construction services are required to use the T5018 form to report those payments. This applies to businesses operating in all provinces, including British Columbia.

The T5018 form is mandatory for any business that has paid a subcontractor $500 or more for construction services during the fiscal year.

Construction services include activities such as excavation, site preparation, carpentry, plumbing, electrical work, and landscaping, among others.

In British Columbia, the T5018 form is particularly relevant due to the significant construction industry in the province.

The province has specific legislation related to the reporting of subcontractor payments for construction services, and failure to comply with these requirements can result in penalties.

In short, any business operating in British Columbia that has paid subcontractors for construction services should ensure they are using the T5018 form to report those payments accurately and on time, to avoid any potential penalties or legal issues.

Who is a contractor, under the T5018?

In British Columbia, the Canada Revenue Agency’s (CRA) T5018 form requires businesses to report payments made to subcontractors for construction services.

The definition of a subcontractor for the purposes of the T5018 form is broad and includes a range of individuals and groups that perform construction-related work.

One group classified as contractors in British Columbia under the T5018 CRA form are independent contractors. These are individuals who work on a self-employed basis, and may offer their services to multiple clients. Independent contractors may provide a range of construction-related services, including carpentry, plumbing, electrical work, and more.

As mentioned above, there are various definitions of subcontractors in the eyes of the CRA, which include:

- A partnership is an association of two or more individuals who carry on a business together, and who share profits and losses.

In the context of the T5018 form, partnerships may include entities such as a general contractor and a subcontractor working together on a construction project.

- Limited companies are also classified as contractors in British Columbia under the T5018 CRA form.

A limited company is a separate legal entity that is owned by shareholders. Limited companies may be involved in construction-related activities, such as providing engineering or architectural services, or managing a construction project.

- Sole proprietorships are another group that may be classified as contractors in British Columbia under the T5018 CRA form.

A sole proprietorship is an unincorporated business that is owned and operated by a single individual. Sole proprietors may provide a range of construction-related services, such as landscaping, painting, or roofing.

In short, the T5018 CRA form requires businesses to report payments made to a range of contractors in British Columbia, including independent contractors, partnerships, limited companies, and sole proprietorships.

By accurately reporting these payments, businesses can help to ensure compliance with tax laws and regulations, and support the fair operation of the construction industry in British Columbia.

Why do we use the T5018?

The T5018 form is used in British Columbia for construction companies to report payments made to subcontractors for construction services. This form is specific to the construction industry and is designed to provide the Canada Revenue Agency (CRA) with information about payments made to subcontractors in order to reduce tax evasion and the underground economy.

The T5018 form is used specifically for the construction industry because it allows the CRA to monitor payments made to subcontractors in this sector, which can be more difficult to track than payments made to employees.

This ensures the CRA can ensure that subcontractors are reporting their income accurately and paying their fair share of taxes.

While other tax forms may be used by businesses in British Columbia to report income and expenses, the T5018 form is unique in its focus on the construction industry.

By requiring construction companies to report payments made to subcontractors on this form, the CRA is able to more effectively monitor the construction industry and ensure compliance with tax laws and regulations.

Simply put, the T5018 form is used in British Columbia for construction companies to provide the CRA with information about payments made to subcontractors for construction services.

What activities to put on the T5018?

The business activities that are reported on the T5018 form are related to construction services. This includes activities such as excavation, site preparation, carpentry, plumbing, electrical work, and landscaping, among others.

Any payments made to subcontractors for these types of services must be reported on the T5018 form if the total amount paid is $500 or more during the fiscal year.

The T5018 form requires businesses to provide detailed information about each subcontractor, including their name, address, business number, and the total amount paid for construction services.

The form also requires businesses to provide information about the services provided by each subcontractor, such as the type of work performed and the location of the work.

Overall, the T5018 form is used to report business activities related to construction services, and it is a critical tool for ensuring compliance with tax laws and regulations in Canada.

The 5W’s

Understanding what the T5018 form entails and focuses on is important for small businesses throughout British Columbia and Canada. This is because, come tax time – you don’t want to suddenly realize that you’re reported the wrong operations, or submitted the wrong form for your small business.

However, to help wrap up this article, we’ve provided a quick summary of the 5-W’s of the T5018 form – the who, what, when, where, and why (and, we’ve even included the how).

Who needs to file the T5018?

In British Columbia, businesses that engage in construction activities and make payments to subcontractors for construction services must file the T5018 form with the Canada Revenue Agency (CRA). This includes businesses that are sole proprietors, partnerships, or corporations, and that meet the following criteria:

- The business engages in construction activities: This includes any business that is involved in the construction, alteration, repair, or demolition of a building or structure, or any other construction-related activity.

- The business makes payments to subcontractors for construction services: Any payment made to a subcontractor for construction services must be reported on the T5018 form if the total amount paid is $500 or more during the fiscal year.

Examples of businesses that may need to file the T5018 form in British Columbia include general contractors, developers, architects, engineers, and other businesses involved in construction-related activities.

It’s important to note that failure to file the T5018 form or to accurately report payments made to subcontractors for construction services can result in penalties and fines from the CRA.

As such, it’s critical for businesses in the construction industry to ensure compliance with tax laws and regulations and to file the necessary forms, such as the T5018 form, in a timely and accurate manner.

What do I need to prepare the form?

To properly fill out the T5018 form in British Columbia, businesses need to gather specific materials and information related to the payments made to subcontractors for construction services during the fiscal year. The following is a list of the key materials and information required to complete the T5018 form:

- Business and subcontractor information: This includes the name, address, and business number of the business and each subcontractor who received payments for construction services during the fiscal year.

- Payment information: This includes the total amount paid to each subcontractor for construction services during the fiscal year.

- Service information: This includes a description of the construction services provided by each subcontractor, including the type of work performed and the location of the work.

- Other information: This includes any other information that may be required to accurately report payments made to subcontractors for construction services, such as GST/HST paid or withheld, and any rebates or subsidies received.

Overall, the key to properly filling out the T5018 form is to ensure that all necessary information is gathered and accurately reported. By doing so, businesses can avoid penalties and fines from the Canada Revenue Agency and support the fair operation of the construction industry in British Columbia.

When does the T5018 need to be filed?

In Canada, businesses are required to fill out and submit their T5018 forms to the Canada Revenue Agency (CRA) by the last day of February following the fiscal year in which the payments to subcontractors were made.

For example, if a business made payments to subcontractors for construction services during the 2022 fiscal year, the T5018 form would need to be submitted to the CRA by February 28, 2023. If February 28 falls on a weekend or holiday, the deadline is extended to the next business day.

It’s important for businesses to submit their T5018 forms on time to avoid penalties and fines from the CRA. Late filing penalties can range from $250 to $2,500, depending on the length of the delay and the size of the business.

In addition to the annual T5018 form, businesses may also be required to submit additional forms or information to the CRA throughout the year, such as quarterly GST/HST returns or other tax forms.

Where to submit?

Businesses in British Columbia (specifically, in Vancouver) can submit their T5018 forms to the Canada Revenue Agency (CRA) through a variety of channels. Here are some options:

- Online: Businesses can submit their T5018 forms electronically through the CRA’s My Business Account service. To use this service, businesses must have an online account with the CRA.

- Mail: Businesses can mail their completed T5018 forms to the CRA’s tax center for their region. The address for the tax center can be found on the CRA website.

- In-person: Businesses can visit a CRA tax services office in Vancouver to submit their T5018 forms in person. The CRA has several tax services offices in British Columbia, so businesses should consult the CRA website to see which office is closest to them.

It’s important for businesses to ensure that their T5018 forms are filled out accurately and submitted on time to avoid penalties and fines from the CRA.

Why it’s important for businesses?

In this article, we’ve discussed the overall importance of the T5018 form. However, for the sake of rounding out our 5-W’s we want to summarize a few top reasons why it’s so important.

At a high level this form is important for small businesses in British Columbia that work in the construction industry because it helps them meet their tax reporting obligations and stay compliant with Canadian tax laws.

Specifically, the T5018 form is used to report payments made to subcontractors for construction services during the fiscal year. By properly completing and submitting the T5018 form to the Canada Revenue Agency (CRA), small businesses can avoid penalties and fines for non-compliance and support the integrity of the construction industry in British Columbia.

Here are a few additional reasons why the T5018 form is particularly important for small businesses in British Columbia:

- Tax compliance: Small businesses in British Columbia must comply with Canadian tax laws and regulations, including reporting payments made to subcontractors for construction services – to help make sure they meet their tax obligations.

- Accurate record-keeping: The T5018 form requires businesses to keep accurate records of payments made to subcontractors for construction services, including the amount paid and the services provided.

- Fair competition: By reporting payments made to subcontractors on the T5018 form, small businesses in British Columbia can support the fair operation of the construction industry. This helps to ensure that all businesses are competing on a level playing field and that the industry as a whole is operating in a fair and transparent manner.

Overall, the T5018 form is an important tool for small businesses in British Columbia that work in the construction industry. By completing and submitting the form on time, small businesses can meet their tax reporting obligations, avoid penalties and fines, and support the fair operation of the industry.

How businesses can fill out the T5018

The most straightforward option for most businesses to fill out the T5018 form is to simply do it in-house by themselves. This involves them preparing the information listed above, and printing off the form to mail it in, or filling it out online to submit it to the CRA digitally.

This, however, can be a long and tedious process; and, if there’s any mistakes on the form – this can lead to much grander repercussions down the road come tax season.

So, how do construction businesses accurately fill out the form in a timely manner?

The best recommendation that we have is to work with a bookkeeping or accounting firm that not only understands your businesses operations and finances but knows how to report them to the CRA to keep you out of hot water at tax time.

At Valley Business Centre – Bookkeeping & Payroll, we understand not only what the T5018 form is, but how to fill it out for your business. For over 30 years, Valley Business Centre – Bookkeeping & Payroll has been providing comprehensive bookkeeping, tax, and remote bookkeeping services to our clients in Whistler, Squamish, the Sea to Sky Corridor and metro Vancouver B.C. areas. Valley Business Centre provides reliable and effective services to all clients.

Disclaimer

This article is written for informational purposes only. It is current at the date of posting and changes to laws and regulation may result in the information becoming outdated. It is not intended to provide legal, tax, or financial advice. It is recommended that readers get advice from a tax professional before making any final decisions.