According to the government of Canada, as of December 2018, 97.9% of businesses were classified as small businesses. Most provinces averaged between 96% and 97% small businesses, but B.C. was one of 4 provinces that had an even higher number of small businesses in the market.

In B.C. 98.2% of businesses are classified as small businesses, with a large number of these in Vancouver and other metropolitan areas. With over a million small businesses, it is important for business owners to understand how they are taxed on different types of income.

More specifically, these small businesses need to know what is classified as passive income and what is classified as active income—and the taxation differences between the two.

Active business income is generally the main and incidental income that businesses will earn. Most often, this is seen in the form of the sale of products or services by a company. Passive investment income, on the other hand, generally consists of corporate earnings not directly related to those core business services and operations. This passive income can include interest, dividends, capital gains, royalties, and some types of rental income.

Simply put, it’s money that comes in with very little effort needed to earn. Most often, passive income is commonly referred to as “investment income”, because investments (whether in real estate, stocks, or other areas) are the most common source of sustainable passive incomes for small businesses.

In today’s markets, and with changes in businesses being brought on by COVID restrictions in Vancouver and B.C., many small businesses in B.C. are focusing on creating passive income streams to help support their businesses. However, there are very different taxation rules for small business passive income.

If Vancouver-based businesses want to maximize how they earn from investment income, it is important to understand how Canadian-controlled private corporation (CCPC) is taxed. A CCPC is a private corporation that is controlled by Canadian residents. It cannot have a non-resident directly or indirectly in control of the business, and it cannot be directly or indirectly controlled by one or more public corporations. It also cannot be controlled by a Canadian resident corporation that lists its shares on a designated stock exchange outside of Canada.

In simpler terms, a CCPC is a private Canadian-owned and controlled business that is not listed on any stock exchange. It is important to know what a CCPC is because most small businesses throughout Canada are CCPC’s. In addition to this, investment income taxation rules across Canada and B.C. are established for CCPCs.

Prior to 2019, passive income was taxed just the same as active income for CCPCs. In other words, small businesses were just taxed on whatever was deemed as income for the business, whether it was passive or active income.

In 2019, however, the legislation changed surrounding the taxation of CCPC passive and investment incomes. These changes effectively increased the amount of taxes being paid by CCPC, resulting in some important pieces of information to cover.

One of the biggest changes to the taxation of investment income is that the small business deduction (SBD) limit is $500,000. The SBD is the maximum value to get a reduction in corporate taxes for CCPCs. With the new rules around passive income over $50,000 starting in 2019 and the effects it has on SBD, small business owners in Vancouver, and throughout the rest of B.C. need to take note of what changes apply to them—and consult their financial professionals with any questions.

In 2019, the corporate tax rate was 38%. After the federal tax abatement of 10%, the tax rate became 28%.

A CCPC, however, receives an additional 19% tax credit or small business deduction on their small business income up to the SBD of $500,000. This means that for up to $500,000, the federal tax rate was 9%. A CCPC’s active business income after that amount is taxed at 15%. Investment income is taxed at 38.7%. This clearly shows that a CCPC would like to maximize this tax credit.

In addition to the federal tax rate, each province (and territory) has its own tax rates for small business income, active business income, and investment incomes. The tax rates for small business income ranged from 0% up to 6%, and for the active business income they ranged from 11.5%-16% and investment income ranged from 11.5% to 16%.

Specifically, in 2019, the rates for BC were 12% for active business income and 2% for CCPCs, up to $500,000. The investment income was also taxed at 12%. These differences in taxation are clearly significant and could provide tax savings up to a maximum of $80,000. It is important to note these rates throughout B.C., because of the large number of CCPCs throughout the province.

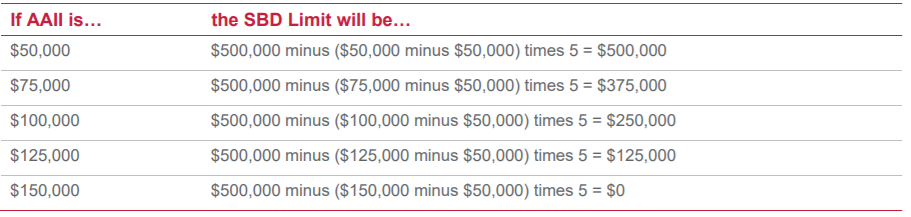

Again, because of these tax rates, it’s important is to keep your SBD at a $500,000 maximum. You need to carefully watch your passive income because the SBD can be reduced for CCPCs based on levels of “adjusted aggregate investment income” (AAII). The SBD will be reduced by $5 for each $1 of investment income that is earned, over $50,000 of AAII.

Looking at these tax rates, you can see that it is not profitable to earn passive income from investments that are over $50,000. As stated above, for $1 of passive income that is earned over $50,000, the SBD is reduced by $5. If your passive income were to reach $150,000, your SBD would be reduced to $0. That would be a huge tax hit. CIBC provides a summary of the new taxation limits in Vancouver and Canada in the following figure:

Looking at these tax rates, you can see that it is not profitable to earn passive income from investments that are over $50,000. As stated above, for $1 of passive income that is earned over $50,000, the SBD is reduced by $5. If your passive income were to reach $150,000, your SBD would be reduced to $0. That would be a huge tax hit. CIBC provides a summary of the new taxation limits in Vancouver and Canada in the following figure:

What this table shows is that as soon as your business exceeds $50,000 of passive, investment income, you start to have a lower SBD limit, meaning you may lose profitability in the long run.

As an example, to clarify this, if you had a passive income of $100,000, you would be $50,000 over the allowed threshold of passive income. This additional $50,000, would then be multiplied by $5, equalling $250,000. This $250,000 is now deducted from your SBD of $500,000.

What this means is that the first $250,000 of investment and passive income would be taxed at a reduced rate. Anything earned over the new SBD value of $250,000 would now be taxed at the higher corporate tax rate or active business income. Again, when looking at the difference in tax rates, this is considerable.

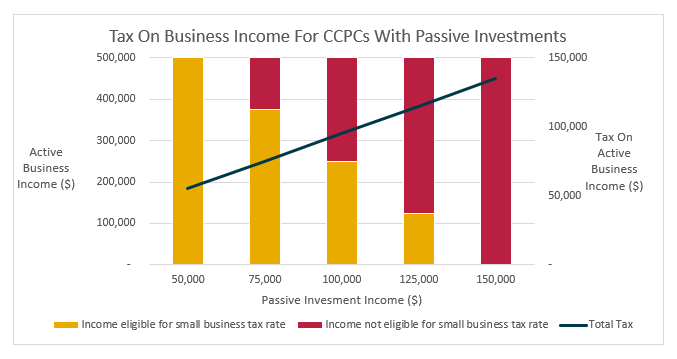

Below is a graph to help show you the effects of passive income over the $50,000 threshold.

The key reason for this change in legislation is that the government wanted to make a change to promote more sales and active income driving business growth and reduce the number of businesses that were relying on investments to make money. As well, they recognized that businesses were taking advantage of tax deferrals by investing their active business incomes rather than investing personally.

With every small business being different, CCPCs should review the passive income rules with their financial professional to review their current holdings and look at possible options. Some options are simple, some are more complex. For example, a company could look at how tax-deferred investments can offer a tax-preferred means of earning passive investment income.

This could include deferring capital gains where possible. As well, growth within a corporate-owned (exempt) life insurance policy will not affect the CCPCs passive investment income and the death benefit may be paid out as a tax-free dividend. Another option could be to look into passive income earners that are required to pay a less annual tax, such as real estate. To sum up, different types of passive income can be treated differently when it comes to taxes.

There are a lot of different options with regards to how to deal with passive, or investment income.

This is why it’s so important to not only monitor investment/ passive income but to also make sure you always make sure you know what tax rates apply to your business based on your CCPC investment income and your SBD limit. Always remember to plan ahead and speak with a professional as this can save you at tax time or hurt your bottom line.

Need help from an expert?

If you need clarification on which types of dividends, royalties, and rental income are classified as passive income, let one of our experts at Valley Business Centre help. For over 30 years, Valley Business Centre has been providing comprehensive bookkeeping, payroll, and tax services to our clients in Whistler, Squamish, the Sea to Sky Corridor, and Metro Vancouver BC areas. Valley Business Centre provides reliable and effective services to all clients.

Disclaimer

This article is written for informational purposes only. It is current at the date of posting and changes to laws and regulations may result in the information becoming outdated. It is not intended to provide legal, tax, or financial advice. It is recommended that readers get advice from a tax professional before making any final decisions.