BC speculation and vacancy tax 2026 is one of those compliance items that tends to sneak up on businesses because it is tied to residential property, not “tax season” in the usual sense.

If your company owns a condo used as staff housing, runs furnished rentals, holds a residential unit inside a mixed-use building, or has a holding company on title, you can be pulled into the annual declaration cycle. Even if you ultimately owe nothing, you still need to file, and you need enough documentation to back up the position you took.

I will walk you through what changed for 2026, which business scenarios I see most often, and what records to keep so your declaration is supported by more than a calendar screenshot and a few emails.

What BC speculation and vacancy tax 2026 means for business owners

The BC Speculation and Vacancy Tax (SVT) is an annual tax that applies to residential properties in designated taxable areas of British Columbia. It is aimed at reducing speculation and encouraging homes to be used as housing.

From a business perspective, the “gotchas” are usually not about the concept of the tax. They are operational:

You must declare each year, even if you are exempt. If you miss the declaration or cannot support your exemption, you can end up dealing with assessments, follow-up questions, and cash flow surprises.

For the official rules, definitions, and filing process behind BC speculation and vacancy tax 2026, start with the province’s guide on how the speculation and vacancy tax works.

Where this turns into a bookkeeping issue is simple: SVT compliance lives at the intersection of property use, ownership structure, and documentation. Those three things tend to drift over time unless someone is actively minding them.

If you already run a tight month-end close, you are ahead. If your rental paperwork lives in someone’s inbox and your ownership documents are scattered across old folders, BC speculation and vacancy tax 2026 is your nudge to clean it up.

Who the SVT affects: business scenarios you will recognize

I am going to stay practical here and talk about where businesses get exposed. In most cases, it is not a giant portfolio. It is one or two units that someone “forgot counted.”

Corporations and holding companies that own staff or executive housing

This is common in Vancouver, Victoria, Kelowna, and other higher-cost markets. A company buys a condo for a rotating team, an executive suite, or temporary relocation. It feels like a business asset, so SVT is not top of mind.

But SVT is based on the property being residential and located in a taxable area, not on whether your intent was “business use.” BC speculation and vacancy tax 2026 can still apply, and your exemption position depends on facts and documentation.

If you are weighing corporate ownership of real estate for staff housing or an executive suite, it is worth stepping back and looking at the bigger tax and structure implications. This guide on should you buy real estate with your corporation walks through the practical considerations that often show up before SVT even enters the conversation.

Mixed-use buildings with a residential component

Some businesses own mixed-use property, or they buy a strata unit in a building that has both commercial and residential components. The SVT can apply to the residential portion or classification, depending on how the property is assessed and used.

The key point: “Mostly commercial” is not the same as “not residential.” If there is a residential component, treat BC speculation and vacancy tax 2026 as a live issue and confirm how the property is classified.

Furnished rentals, mid-term stays, and accommodation-style operators

If you run furnished rentals, seasonal stays, or anything that looks like short-term rental operations, you are in the zone where SVT recordkeeping often breaks down. Bookings are spread across platforms. Occupancy is tracked in calendars. Revenue is net of fees. And “available to rent” versus “held back for owner use” is not always documented cleanly.

If that sounds familiar, it is usually a sign your SVT evidence package needs to be tied more closely to your bookkeeping. In particular, bookkeeping for Canadian short-term rental will help you tighten up payout tracking and occupancy support, and GST/HST for non-resident rentals is a useful cross-check when platform income, guests, or ownership structures make the tax side less straightforward

Partnerships, trustees, and multi-owner structures

Once ownership is not “one person, one property,” the SVT administration work increases. Separate owners may need to declare separately, and the applicable tax rate can be impacted by ownership details.

Even if you outsource the filing, you still need the documents and a clear internal process, because BC speculation and vacancy tax 2026 is not forgiving when the declaration is missed or filed with incomplete information.

What changed in 2026: rates, credits, and deadline reminders

This is the part decision-makers usually care about first because it affects cost and risk.

Rate increases starting in 2026

The province increased the SVT rates beginning in 2026. According to the Government of British Columbia’s SVT tax rates page:

- For Canadian citizens and permanent residents (who are not categorized as “untaxed worldwide earners”), the rate increases to 1% (up from 0.5%).

- For foreign owners and “untaxed worldwide earners,” the rate increases to 3% (up from 2%).

If you are budgeting risk or reviewing exposure, the province lays out the 2026 rate changes clearly on its page for SVT tax rates in British Columbia, including the increase for Canadian citizens and permanent residents and the higher rate for foreign owners and untaxed worldwide earners.

Even if your business expects to be exempt, rate increases matter because they increase the cost of getting it wrong. BC speculation and vacancy tax 2026 raises the stakes on documentation and timely filing.

The B.C. resident tax credit doubled (max credit increased)

For owners who qualify for the B.C. resident SVT credit, the maximum credit increased from $2,000 (2018 to 2025) to $4,000 (2026 and after). The province summarizes eligibility and supporting details under SVT tax credits, which is worth reviewing before you finalize your filing position.

In a business setting, tax credits often come down to whether you can produce the right supporting items quickly when requested. That is why I treat BC speculation and vacancy tax 2026 as much a records project as a tax project.

Timing reminders you should build into your annual compliance calendar

SVT declarations are generally due by March 31 each year, and if tax is payable the amount is due on the first business day in July (the province includes examples, such as July 2, 2026, for a relevant cycle). You can confirm the current process and timing directly in the province’s guide on how the speculation and vacancy tax works.

Also important: if you do not declare, you can be assessed without the benefit of your exemption position. In plain terms, failing to file can push you toward the most expensive interpretation of your situation.

If you already maintain an annual compliance calendar for payroll and tax items, fold BC speculation and vacancy tax 2026 into it the same way you would handle T4 deadlines or annual corporate filings. If you want a framework for building that habit, this post can help: Year-End Checklist: Wrapping Up Your Bookkeeping and Payroll for a Successful New Year in Canada

Records businesses should keep to support exemptions and claims

Here is the simple rule I use with clients: if you cannot prove it with documents you can produce quickly, assume it will not feel “proven” in an audit or review.

That does not mean you need to overcomplicate it. It means you need consistency.

BC speculation and vacancy tax 2026 recordkeeping package for rental and staff housing units

If you want a clean, audit-ready file, build it around five buckets.

1) Occupancy and rental proof (leases and rent trail)

Keep signed leases, amendments, and renewal letters. For each unit, you should be able to show start and end dates and connect rent charged to rent received.

In bookkeeping terms, that usually means:

A rent roll that matches the lease terms.

A tenant ledger (or sub-ledger) that shows invoices, receipts, and balances.

Bank deposit support that ties back to rent receipts.

If you do monthly bank reconciliations, you are already partway there. If you do not, this is a good reason to start, because BC speculation and vacancy tax 2026 is one more situation where clean reconciliations protect you.

2) Furnished rental and accommodation operator support (beyond a calendar)

Calendars are helpful, but they are not accounting evidence by themselves. What holds up better is a package that ties occupancy to revenue.

For furnished rentals, keep:

Platform statements (Airbnb, VRBO, Booking.com, or your booking engine) showing payouts, fees, and reservation detail.

Occupancy exports by month, not just screenshots.

Guest agreements and house rules acceptance, if you use them.

Cleaning and turnover invoices or logs.

Property management agreements, if outsourced.

This is also where people get tripped up on sales tax. If you are running short-term accommodation, GST/HST and PST considerations can ride alongside SVT compliance, so it is worth cross-checking your setup against the CRA’s GST/HST guidance for real property and rentals and the province’s BC PST rules and information. When your books reconcile platform payouts properly, BC speculation and vacancy tax 2026 becomes easier because you can prove both use and revenue.

When your books reconcile platform payouts properly, BC speculation and vacancy tax 2026 becomes easier because you can prove both use and revenue.

3) Mixed-use and classification support

If there is any mixed-use element, keep documents that support how the space is classified and used.

Property tax assessment and classification documents are a good baseline. When you are sorting out classification questions, BC Assessment is a helpful reference point for understanding how properties are categorized and assessed.

If you have floor plans, strata plans, or permits that support the actual use, keep them in the same SVT folder. The goal is not to build a legal case file. The goal is to be able to answer questions without scrambling.

4) Ownership and control documentation

This is the bucket that gets missed most often in corporate settings.

For each property, keep:

Title and ownership shares.

Shareholder register or corporate ownership summary.

Partnership agreements or trust documents, if applicable.

Board resolutions or internal policy documents for staff housing or executive use, if that is your fact pattern.

Why this matters: BC speculation and vacancy tax 2026 can become complicated when the ownership structure changes mid-year or when the “who is on title” story does not match the “who controls it” story.

If you want this to feel routine year after year, the key is having a consistent documentation habit, not a scramble in March. This post on maintaining proper documentation for your business explains how to build a simple system so leases, ownership records, and support files are easy to retrieve when you need them.

5) Income tax support for credits where applicable

The province notes that credits for other owners may require CRA Notices of Assessment and support for B.C. income, depending on the credit being claimed. The cleanest place to confirm what is required for your situation is the province’s page on SVT tax credits.

Even if you do not personally handle the credit application, your finance team should know where the Notices of Assessment live and how quickly they can be produced. That is part of making BC speculation and vacancy tax 2026 routine instead of painful.

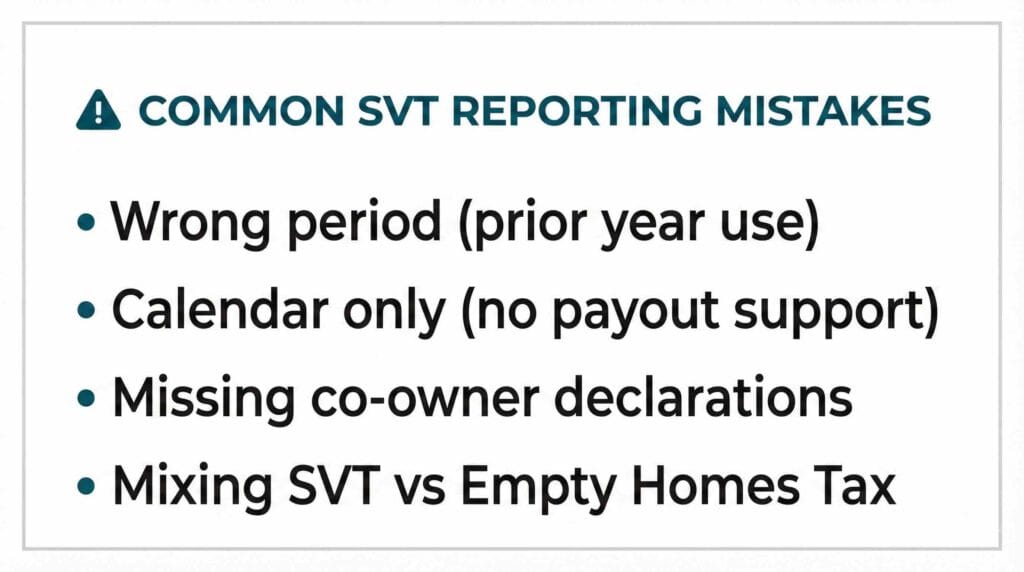

Common reporting mistakes (and how to avoid them)

I see the same issues repeat, especially in growing businesses where responsibility is spread across operations, finance, and sometimes an external property manager.

First, assuming “it was rented sometimes” is enough. It is not. You need to match the qualifying thresholds with documents that show the rental period clearly.

Second, using the wrong period. SVT declarations generally ask how the property was used in the prior year, and people answer based on the current year because that is what they remember. Build your SVT file by calendar year so you are not guessing.

Third, forgetting that co-owners may each need to declare. This comes up with partner arrangements, holdco plus individual ownership mixes, and trust situations.

Fourth, treating a furnished rental calendar as proof without tying it to revenue and bank deposits. If your accounting system cannot trace platform payouts to specific periods, BC speculation and vacancy tax 2026 becomes harder to support.

Fifth, mixing SVT up with other housing taxes and measures. For example, the Vancouver Empty Homes Tax is separate from SVT and has its own process, deadlines, and documentation. If you operate in Vancouver, keep the rules distinct in your compliance calendar so you are not trying to solve two different filings at the same time.

A quick compliance checklist for businesses with residential units

This is the part I would hand to an operations manager or controller and ask them to confirm once a year. Keep it short, make it repeatable, and store evidence in one place.

- List every residential property or unit your business owns or controls in SVT taxable areas.

- Confirm who is responsible for the SVT declaration each year and set a March 31 reminder.

- Store SVT letter IDs and declaration codes in a secure, shared location (not one person’s email).

- For long-term rentals, ensure lease dates match the rent roll and tenant ledger.

- Reconcile rent deposits to the bank monthly so the rent trail is clean.

- For furnished rentals, export platform statements and occupancy reports monthly or quarterly.

- Document any owner, staff, or executive use periods with a simple internal log and policy.

- Keep cleaning logs, turnover invoices, and management agreements together for accommodation-style units.

- Maintain an up-to-date ownership file (title, shareholder register, partnership or trust documents).

- Keep CRA Notices of Assessment accessible if you expect to rely on credits.

- If you have mixed-use property, file the property tax classification and any supporting floor plans.

- Review your file in February so BC speculation and vacancy tax 2026 does not become a March scramble.

If you are building stronger finance processes anyway, pair this SVT checklist with a basic internal controls tune-up. The same habits that prevent payroll and year-end surprises also make SVT compliance smoother, especially when multiple people touch the records. This overview of internal controls in your business is a good starting point for tightening responsibility, storage, and review steps.

How I would approach this as your bookkeeper or finance partner

Here is the practical way I help clients reduce SVT stress without turning it into a giant project.

We start by identifying which properties are in scope and who is filing. Then we build a simple “SVT evidence folder” structure for each property, aligned to the five record buckets above. Finally, we connect the accounting records to that folder so the rent trail and platform payouts are not a separate universe.

When that is done, BC speculation and vacancy tax 2026 becomes routine. You are not trying to recreate a year of activity from memory. You are pulling a clean package.

If your business has staff housing, furnished rentals, or a corporation-held condo, consider booking an SVT readiness review with your accountant or bookkeeper before filing season. It is usually cheaper to tidy records proactively than to respond under pressure.

One last reminder: SVT is provincial. Your income tax return, GST/HST filings, and payroll compliance are separate systems with separate deadlines. But the same bookkeeping foundation supports all of them. Clean reconciliations, consistent documentation, and clear ownership records reduce risk across the board, not just for BC speculation and vacancy tax 2026.

At Valley Business Centre, we’ve supported businesses across Metro Vancouver, Whistler, Squamish, and the Sea to Sky Corridor for more than 30 years with bookkeeping, payroll, tax preparation, and cloud accounting systems.

If you’re a BC business in Vancouver, Surrey, Burnaby, Richmond, Coquitlam, or North Vancouver and you want your SVT declarations handled properly without last-minute scrambling, reach out. We can help you tighten up tracking, reconcile deposits and payouts, and keep documentation organized so SVT season feels manageable instead of messy.